Can Services Replace Manufacturers as the drivers of the economy? Dani Rodrik writes: The global discussion about growth in the developing world has taken a sharp turn recently. The hype and excitement of recent years over the prospect of rapid catch-up with the advanced economies have evaporated. Few serious analysts still believe that the spectacular economic convergence experienced by Asian countries, and less spectacularly by most Latin American and African countries, will be sustained in the decades ahead. The low interest rates, high commodity prices, rapid globalization, and post-Cold War stability that underpinned this extraordinary period are unlikely to persist.

A second realization has sunk in: Developing countries need a new growth model. The problem is not just that they need to wean themselves from their reliance on fickle capital inflows and commodity booms, which have often left them vulnerable to shocks and prone to crises. More important, export-oriented industrialization, history’s most certain path to riches, may have run its course.

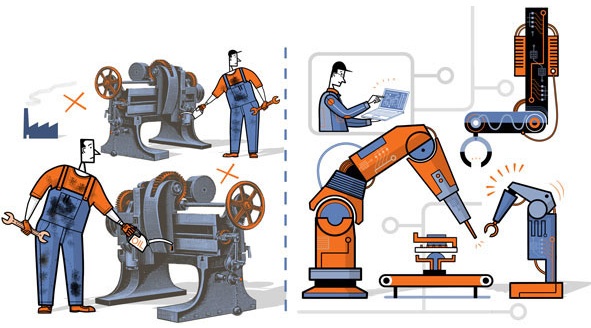

Ever since the Industrial Revolution, manufacturing has been the key to rapid economic growth. China, which has emerged as the archetype of this growth strategy since the 1970s, traveled a well-worn path: industrial manufacturing.

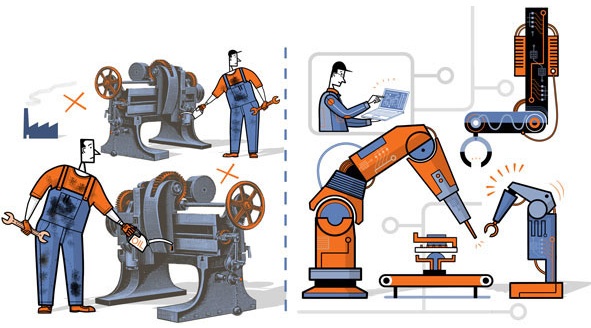

But manufacturing today is not what it used to be. It has become much more capital- and skill-intensive, with greatly diminished potential to absorb large amounts of labor from the countryside.

While global supply chains have facilitated entry into manufacturing, they have also reduced the gains in terms of value added that accrue at home. Many traditional industries, such as textiles and steel, are likely to face shrinking global markets and over-capacity, driven by demand shifts and environmental concerns. And one downside of China’s success is that many other countries are finding it much harder to establish more than a niche in manufacturing.

Can service industries play the role that manufacturing did in the past?

Among the optimists are Ejaz Ghani and Stephen D. O’Connell of the World Bank argue that service industries could serve as a growth escalator, the role traditionally assumed by manufacturing.

In particular, they show that services have exhibited “unconditional convergence” in productivity recently. That is, countries furthest away from the global frontier of labor productivity have seen the fastest productivity growth in services.

This would be very good news, but there are reasons to be wary. The Ghani-O’Connell evidence includes data starting in the early 1990s, during which developing countries were experiencing economy-wide convergence, boosted by capital inflows and commodity windfalls. It is unclear whether their conclusions extend to other periods.

Two things make services different from manufacturing. First, while some segments of services are tradable and are becoming more important in global commerce, these typically are highly skill-intensive sectors that employ comparatively few ordinary workers.

Banking, finance, insurance, and other business services, along with information and communications technology (ICT), are all high-productivity activities that pay high wages. They could act as growth escalators in economies where the work force is adequately trained. But developing economies typically have predominantly low-skilled labor forces. In such economies, tradable services cannot absorb more than a fraction of the labor supply.

That is why, for all of its success, the ICT sector in India has not been a primary driver of economic growth. By contrast, traditional manufacturing could offer a large number of jobs to workers straight off the farm, at productivity levels three to four times that in agriculture.

In today’s developing countries, the bulk of excess labor is absorbed in non-tradable services operating at very low levels of productivity, in activities such as retail trade and housework. In principle, many of these activities could benefit from better technologies, improved organization, and greater formalization. But here the second difference between services and manufacturing comes into play.

Partial productivity gains in non-tradable activities are ultimately self-limiting, because individual service activities cannot expand without turning their terms of trade against themselves. By contrast, in services, where market size is limited by domestic demand, continued success requires complementary and simultaneous gains in productivity in the rest of the economy.

So I remain skeptical that a services-led model can deliver rapid growth and good jobs in the way that manufacturing once did. Even if the technological optimists are right, it is difficult to see how that will enable developing countries to sustain the kind of growth they experienced over the last couple of decades.