“You’re one of the household names in American politics,” Colbert said, “and yet you are one of the few household names that is not running for president of the United States. Are you sure you’re not running for president of the United States? Have you checked the newspapers lately? Because a lot of people have jumped in. You might have done it in your sleep.”

“I’m sure I’m not,” Warren said.

“These days, politicians actually have to check the opt-out button,” Colbert said. But he wasn’t ready to give up.

“Can you tell us why you’d be such a terrible choice?” Colbert said. “… Why we shouldn’t be clamoring for an Elizabeth Warren presidency?”

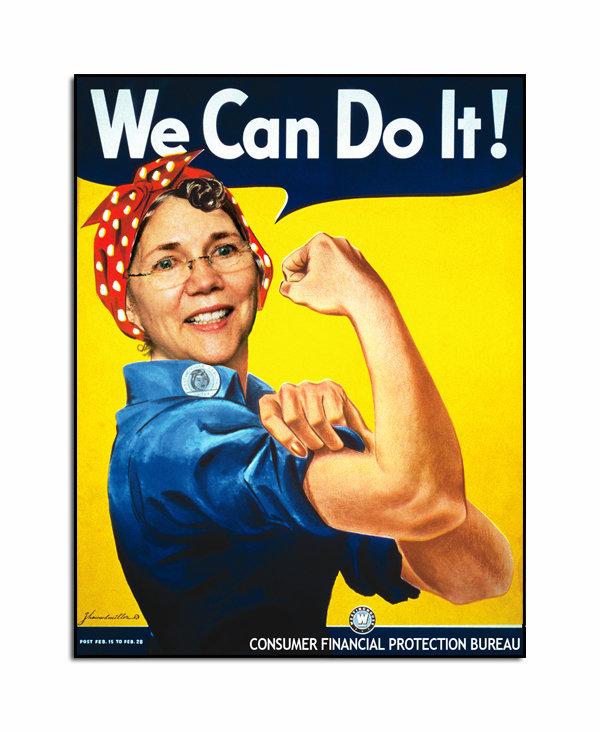

“I’m out there every single day,” Warren said, “in the middle of a huge fight. And it’s a fight about what this country is going to look like going forward. The game is rigged.”

“What is the game you’re talking about?” Colbert said.

“I’m talking about our country and how it’s run,” the senator said. “… We have a federal government that works great for millionaires, it works great for billionaires, it works great for giant corporations.”

But many, Warren said, were left out.

“For the rest of America, it’s just not working,” Warren said. “It’s time for us to take that government back.”

Colbert’s crowd erupted in applause.

“Well, you don’t sound like you’re running for president,” the show’s host said.

In Colbert’s previous life as a buffoonish right-winger on Comedy Central’s “Colbert Report” in 2014, the talk-show host needled Warren about the benefits of lax financial regulation – mostly to her benefit.

“Have you ever heard of the invisible hand of the market?” Colbert said. “You can’t put handcuffs on an invisible hand. The cops can’t find it… . What you call breaking the law, I call pushing the envelope.”

“You can put handcuffs on people that break the envelope,” Warren said. “When they break the law, they deserve to have handcuffs.”