The systemic financial risk-taking in the lead up to the financial crisis was a product of untouchable insiders taking risks that favored the connected few. And the many still suffer. Cameron K. Murray write: Not only are there insider groups bridging Wall Street and financial regulators, but Defense Departments are a hotbed of revolving personnel into, and out of, private weapons and hardware manufacturers. At local government levels this type of revolving door of well-connected insiders is even more insidious, with land rezoning and infrastructure spending a constant battle between in the interests of the insiders and the community at large. The revolving door culture is now so pervasive that Federal Reserve Chairman Ben Bernanke, arguably the most powerful financial regulator in recent history, waltzed through the door to consult for a multi-billion dollar hedge fund with almost no media criticism. Few issues are more important than being governed in the interest of the few at the expense of the many. The economic costs of this behaviour are likely to be in the hundreds of billions of dollars annually. Yet from a standard economic viewpoint, the mechanism by which such favouritism occurs remains a mystery. To shine some light on the mechanisms in coordinating back-scratching, its costs, and potential institutional changes to combat it, I took the problem to the lab under computerised experimental conditions. While the results confirm a lot of common sense intuition, they are a leap forward in terms of our economic understanding of the problem. Regulatory capture is the name economists give to the perverse effects of the revolving door, yet its effects on behavior are not the product of a coherent theoretical framework. For regulators to act in the interests of their former, or potentially future, employers requires a level of implicit collusion that shouldn’t exist in a world of purely self-interested agents who would defect from any attempt to form a group of allied insiders. Something else must be going on. Another view in standard economics is that political favors are imagined to be auctioned by way of a lottery, where bidders devote their resources to non-productive activities, such as attending political fundraisers, up to the amount of their expected payoff from the political favor subject to the participation of others in the lottery. This is called rent-seeking. The prize of a political favour is open to anyone, and we should expect, just like we see in real lotteries, no specific entrenchment of particular interest groups and a high degree of randomness in allocation of political favors. Back-scratching, corruption and regulation

Category Archives: Corruption

State Banks the Answer?

Banking in the Spotlight in New Mexico

There was a recent Symposium in Albuquerque, New Mexico on November 7, 2015 to Promote Public Banking.

First of all, what is a Public Bank? I am not sure there is a good definition but presumably it is not a private bank or even a non-profit bank but in some sense is associated with government and I think we are talking here about something other than the Central Bank of a nation. Thus perhaps the best way to look at a Public Bank is that it is a bank owned by a political jurisdiction and intended to advance the interests of the political jurisdiction which presumably means the residents of that political jurisdiction. But there may be differences of opinion as to the range of services that need to be provided in order for this entity to be considered a bank. It is important to understand that certain banking functions are performed by governmental entities which do not have a bank charter. This could be important.

Here are statements by a state legislator. First, after eleven years in the Legislature, I was astonished to see, in a “weekly report of activity” from the LFC. The LFC is the Legislative Finance Committee which employs fiscal analysts who examine budgets and review the management and operations of state agencies, higher education institutions and public schools and participate in the state’s revenue estimating process. Buried in a paragraph updating us on department activity, the sentence that “the Department of Transportation had awarded a $6 million loan for a wastewater system with Estancia. The funds will be processed through the State Infrastructure Bank.”

I was astonished for two reasons: first, what is the Transportation Department doing lending money for waste water infrastructure? Second, what in the world is the State Infrastructure Bank? I confess in my time as a legislator, this entity had never been mentioned to me…at least I couldn’t recollect ever hearing about it. So I did a bit of internet research, and while the NM State Infrastructure Bank eluded my search, the general concept of state infrastructure banks produced a wealth of information. I now realize that we are among the states which have for years been utilizing this simple method of financing some of our projects for highways and water. I couldn’t determine for sure, but it appears in NM we have housed the “bank” in the department of transportation (bridges and roads would be one of the uses, so this makes sense).

State Infrastructure banks are “a well-regulated method for financing projects selected by the state. A low-interest, below market rate, loan is issued to finance the project. Repayments, including interest, return to the bank and are then available for lending out for additional projects.” What struck me about the existence of this mechanism is that it is precisely the way a public bank would function. We, in effect, already have one–just haven’t named it as such and haven’t made full use of its simple, elegant mechanism…so why not?

The power of the banking lobby. Their program fits with their overall strategy of convincing Americans that banking is far too complex an issue to be attempted by anyone but members of the banking brotherhood. Leave your financial dealings to us…you’ll just screw them up. This ignores the reality that is described in numerous books I’ve been reading on the topic following last fall’s symposium on public banking in Santa Fe. Ellen Brown’s “Web of Debt” is the cornerstone for the discussion. Michael Lewis, among others, has explored just how it was possible for the banking industry to get things so terribly wrong during the housing bubble and the resulting crash of 2008 in “The Big Short” and “Boomerang”. What becomes clear from these works is that bankers are NOT the smartest guys in the room; that in fact the incredible profit they are able to produce out of public financial dealings is in no way a necessity. Instead, there is plenty of room for a state (like North Dakota) or a City (as Santa Fe is attempting) to omit the banking industry from many (if not all) of its finances.

Like you, I think it would make sense to move slowly and carefully in incremental steps, building on those activities in state government that are already very much like public banking, like my new discovery of the State Infrastructure Bank (SIB) or the State Investment Council (SIC). What I would see happening first would be to expand the SIB’s role, increasing the amount and number of self-financed projects, projects in which we pay ourselves a modest return rather than see public money go into bankers’ vaults for no good reason. In time this could include issuing our own bonds. It could involve an initial deposit from the state operating reserves of a percent or two (each percent represents $62 million and we are currently carrying over 10% reserves, far more than actuaries say is necessary). That deposit, used to finance state or municipal projects (a la the SIB) would earn a better return than we now get from the reserves, which are not invested but retained in a private bank “until we need to withdraw it”.

Governance of a public bank is the big concern. It needs to be as independent as possible from the executive and the legislature. Decisions about its operation should be divorced from political considerations. We can do it…if North Dakota can. In time it could develop into a full-blown State Bank, one that buys a piece of commercial loans entered into by community banks, reducing the overall interest rate and fostering economic growth for local business. Banking in the Spotlight in New Mexico

Resurrecting Dodd Frank?

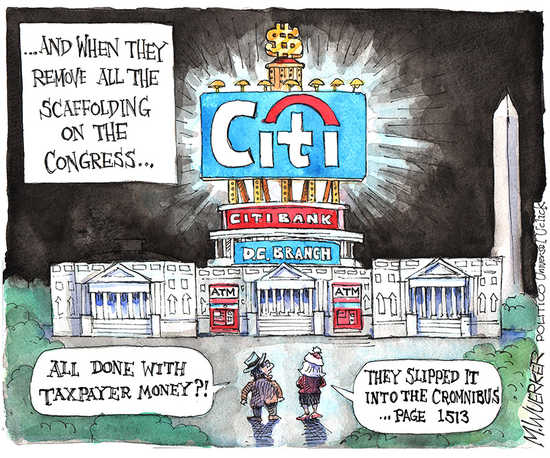

After reportedly finding that partial repeal of Dodd-Frank Act language allows banks to keep trillions in risky trades on the books, U.S. Sen. Elizabeth Warren, D-Mass., called on the Securities and Exchange and Commodity Futures Trading Commissions Monday to implement rules that protect taxpayers and the financial system.

Warren, who joined Maryland Rep. Elijah Cummings in investigating the risks posed to taxpayers following the 2014 partial repeal of the law, also asked the Government Accountability Office to analyze the impact of the modified Dodd-Frank provision.

According to Warren and Cummings’ review, rollback of the section of the law designed to prevent taxpayer bailouts of federally insured banks with risky swaps holdings, now allows banks to keep nearly $10 trillion in swaps trades on their books. The Democrats also found that regulators have failed to analyze the financial and taxpayer risks posed by the repeal.

In a letter to the CFTC and SEC, Warren and Cummings urged the federal agencies to “act quickly to mitigate the risks posed by uncleared swap activities by imposing strong margin requirements for swaps between bank affiliates and other entities under (their) authority.”

Warren and Cummings urged the GAO Comptroller of the total value of swaps U.S. banks originally would’ve been required to “push out” under the provision; an estimate of the total value of swaps U.S. banks will now be required to “push out” under the revised language; and a quantified assessment of the risks implementation of the section would’ve created for U.S. banks.

“The failure to assess the impact on banks and the economy of the repeal of Section 716 raises critical questions about whether federal policymakers are sufficiently attentive to the risk posed by nearly $10 trillion in risky swaps now primary held – and allowed to be traded and held on an ongoing basis – by a handful of the country’s largest FDIC-insured banks,” they wrote. “Understanding this risk is critical as policymakers continue to make decisions about how banks are regulated.”

The 2015 Consolidated and Further Continuing Appropriations Act modified the Dodd-Frank Act section.

Warren and Cummings, who contended that the change was made without debate and after intense lobbying from the financial industry, launched their own investigation into its potential impacts.

Bank Hackers Accused in US

U.S. prosecutors on Tuesday unveiled criminal charges against three men accused of running a sprawling computer hacking and fraud scheme that included a huge attack against JPMorgan Chase & Co and generated hundreds of millions of dollars of illegal profit.

Gery Shalon, Joshua Samuel Aaron and Ziv Orenstein, all from Israel, were charged in a 23-count indictment with alleged crimes targeting 12 companies, including nine financial services companies and media outlets including The Wall Street Journal.

Prosecutors said the enterprise dated from 2007, and caused the exposure of personal information belonging to more than 100 million people.

“By any measure, the data breaches at these firms were breathtaking in scope and in size,” and signal a “brave new world of hacking for profit,” U.S. Attorney Preet Bharara said at a press conference in Manhattan.

The alleged enterprise included pumping up stock prices, online casinos, payment processing for criminals, an illegal bitcoin exchange, and the laundering of money through at least 75 shell companies and accounts around the world.

Tuesday’s charges expand a case first announced in July, and according to U.S. Attorney General Loretta Lynch target “one of the largest thefts of financial-related data in history.”

The charges are also the first tied to the JPMorgan attack, which prosecutors said involved the stealing of records belonging to more than 83 million customers, the largest theft of customer data from a U.S. financial institution.

Authorities said Shalon and Aaron executed that hacking, using a computer server in Egypt that they had rented under an alias that Shalon often used.

Uprooting Corruption in Romania?

Romanians are protesting systemic state corruption.

Thousands of demonstrators returned to the streets of Romania for a fourth night running on Friday to pursue their campaign for a cleansing of the political class in the wake of a deadly nightclub fire.

Having already brought down a government this week, the protesters are saying ‘no’ to more of the same and demanding a root and branch shake-up of a political system and public administration they claim is rife with corruption.

University Square in the capital, Bucharest, was again the centre of their rally.

“We are here to show them we don’t want things to continue the same way – for some politicians to leave and then the same to come back,” said one demonstrator.

“We don’t want the same lies. We will not be tricked by one or two resignations.”

“The problem is that the square, the street, cannot be represented through a few people,” another said.

“President Iohannis and the political figures should come here…and speak to the people.”

Romania’s President Klaus Iohannis has said he will meet protesters on the ground.

In the meantime he has appointed an interim prime minister to replace Victor Ponta, who is facing trial for corruption and quit as premier amid the demonstrations triggered by last Friday’s nightclub fire in Bucharest which killed 32 people and injured nearly 200 more.

How to Keep Bankers Ethical?

Christine Lagarde has called for stronger individual accountability for law-breaking and misconduct in banks.

The managing director of the International Monetary Fund criticised the assumption that fines are simply the “normal cost of doing business”,

She noted that the brunt of corporate malfeasance has been born by bank balance sheets. “A rogue trader might think it’s ok, it’s in the books, provided for.”

From the board to the trading floor, a culture of individual “virtue and integrity” is needed, pointing to the ethical oath Dutch bankers now take. I swear within the boundaries of the position that I hold in the banking sector

- that I will perform my duties with integrity and care;

- that I will carefully balance all the interests involved in the enterprise, namely those of customers, shareholders, employees and the society in which the bank operates;

- that in this balancing, I will put the interests of the customer first;

- that I will behave in accordance with the laws, regulations and codes of conduct that apply to me;

- that I will keep the secrets entrusted to me;

- that I will make no misuse of my banking knowledge;

- that I will be open and transparent, and am aware of my responsibility to society;

- that I will endeavor to maintain and promote confidence in the banking system.

“We need a culture that holds individuals accountable,” she said, arguing that strong criminal and civil action must be taken to act as a deterrent.

Can VW Survive?

Volkswagen AG said it found faulty emissions readings for the first time in gasoline-powered vehicles, widening a scandal that so far had centered on diesel engines. Separately, the company’s Porsche unit said it’s halting North American sales of a model criticized by U.S. regulators.

Volkswagen said an internal probe showed 800,000 cars had “unexplained inconsistencies” concerning their carbon-dioxide output. Previously, the automaker estimated it would need to recall 11 million vehicles worldwide — more than Volkswagen sold last year.

The crisis that emerged after Volkswagen admitted in September to cheating U.S. pollution tests for years with illegal software has shaved more than one-third of the company’s stock price and led to a leadership change. Today’s revelation adds to the pressure on Volkswagen’s new chief executive officer, Matthias Mueller.

Most of the affected cars are in Europe and the 2 billion euros in possible costs are an initial estimate, according to the spokesman. The automaker will determine how much money to set aside once the probe has been finalized, he said.

The EPA said its new investigation centers on the Porsche Cayenne and VW Touareg sport utility vehicles and as well as larger sedans and the Q5 SUV from Audi.

But then late Tuesday, Porsche’s North American division said it would voluntarily discontinue sales of diesel-powered Cayennes from model years 2014 to 2016 until further notice. The Atlanta-based unit’s statement reiterated that the EPA notice was unexpected and that owners can operate their vehicles normally.

Mueller has pledged to overhaul the company’s corporate culture, which he said must change to create a more transparent environment that can discover possible faults.

“This is a painful process, but it is our only alternative,” Mueller said in an e-mailed statement. VW “deeply regrets this situation” and “will stop at nothing and nobody” to get to the bottom of the matter, he said.

The scandal has weighed heavily on Volkswagen’s earnings. The automaker reported its first quarterly loss last month in at least 15 years because of the reserve funds set aside to implement fixes.

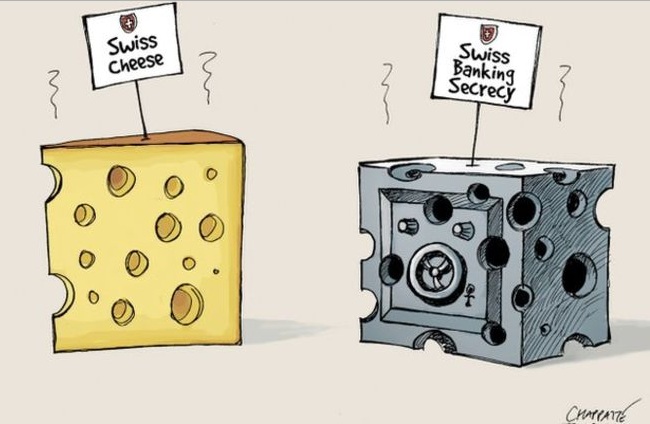

Banking Transparency: Progress?

Most countries’ secrecy scores have improved – transparency has increased. . Real action is being taken to curb financial curb secrecy, as the OECD rolls out a system of automatic information exchange (AIE) where countries share relevant information to tackle tax evasion. The EU is starting to crack open shell companies by creating central registers of beneficial owners and making that information available to anyone with a legitimate interest. The EU is also requiring multinationals to provide country-by-country financial data. But the U.S. is going the other way, rising to third on the list. Higher is bad and Switzerland tops the list, followed by Hong Kong.

Secrecy by country, listed from most to least.

l. Switzerland 2. Hong Kong 3. USA 4. Singapore 5. Cayman 6. Luxembourg 7. Lebanon 8. Germany 9. Bahrain 10. Dubai/UAE

Government Action Against Wrongdoing Bankers?

Reviewing John Coffee’s book “Entrepreneurial Legislation” Judge Jed Rakoff suggests a possible solution to the government’s failure to prosecute in cases of bankers who have clearly violated the law.

Rakoff writes: Coffee, while also strongly advocating for more governmental action against individuals, proposes an interesting innovation that he thinks would make class actions more socially useful and less liable to abuse. Overall, he suggests making good on class action’s promise of a “third way” by combining its profit-seeking tendencies with oversight of the class actions themselves by public agencies. Specifically, he proposes, among other reforms, that government regulators in matters where class actions are common should employ private class action lawyers, on a contingent fee basis, to bring class actions supervised by the regulatory authority but for the benefit of the victims, to whom any recovery would be distributed.

It is hard to believe that the settlements in such cases have much of a deterrent effect on the individual executives who actually committed the alleged misconduct. This is why class actions may be no real substitute for criminal and regulatory prosecution of the individuals actually responsible for corporate misconduct.

Is it possible that enlightened regulators could vindicate the rights of individuals without the massive profit-seeking machinery of the current U.S. legal system, and without the cruel bias toward incarceration of the current U.S. criminal justice system?

Manipulating Markets: Up and Down?

Should we look at who drives stock prices up as well as who helps them go down?

Matt Levine writes about Chinese markets: When Chinese stock markets were crashing earlier this year, authorities were quick to blame short sellers and market manipulation. It’s reasonable to be skeptical. Sometimes markets go down because they are overvalued, not because a cabal of evil hedge fund managers is manipulating them.

Chinese authorities have detained the leading light of the “Limit-up Kamikaze Squad”, a group of hedge fund managers known for their fearless speculation.

Xu Xiang, general manager of Zexi Investment Management, was apprehended on Sunday on suspicion of insider trading after a police manhunt.

He was “captain” of the loose collection of fund managers centred around the coastal city of Ningbo in eastern Zhejiang province who are known for pushing favoured stocks up by the 10 per cent daily limit on Chinese exchanges.

A frequent criticism of these sorts of crackdowns is that authorities are quick to blame manipulative short sellers when stocks go down, but are less concerned about manipulation on the way up. Pushing stocks up is just as manipulative as pushing them down. But in fact, while it’s not clear what exactly the charges against Xu are, they might well be related to upward manipulation.

Mr. Xu’s Zexi Investment, based in Shanghai, was the subject of intense market speculation in September, when a post on social media accused the company of market manipulation. The online post suggested that Zexi had told China’s biggest brokerage, Citic Securities, to buy shares of an unprofitable Shanghai clothing retailer to lift its price for one of its politically connected investors. At the time, Zexi said the attacks were “fabrications from nowhere and malicious attacks.”