The Petrobras scandal has widened to indict Andre Esteves, who claims he is better than Goldman Sachs bankers.

The chief executive of Brazil’s largest independent investment bank and a powerful ruling party senator were arrested early Wednesday as part of an investigation into a massive corruption scandal at state-controlled oil company Petróleo Brasileiro SA.

Authorities in Brasília arrested Sen. Delcídio do Amaral, a member of the governing Workers’ Party and the Senate whip, whose help is seen as critical for President Dilma Rousseff to pass unpopular austerity measures to shore up Brazil’s shaky finances.

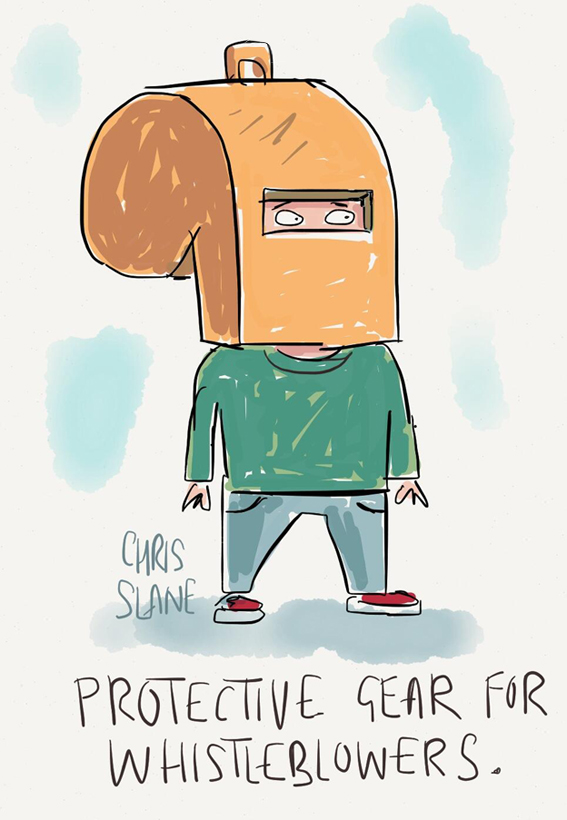

Prosecutors say the two men were conspiring to pay millions in bribes to a key witness in the Petrobras investigation, then spirit him out of Brazil on a private jet to prevent him from turning state’s evidence that could implicate them in the sprawling graft scheme.

The arrests were stunning even by the standards of Brazil’s biggest-ever corruption probe, which has toppled elites at the highest levels of the nation’s business and government. The developments are yet another blow to Ms. Rousseff, whose popularity has plummeted as Brazil’s economy has deteriorated and her party, known as the PT, has become mired in the scandal.

Through his attorney, Mr. Esteves denied wrongdoing. Mr. Amaral’s lawyer said his client is fighting the charges against him.

Messrs. Esteves and Amaral were taken into custody on suspicion they were trying to stop a former Petrobras executive, Nestor Cerveró, from cutting a plea bargain with prosecutors and providing testimony that would link the men with the corruption scandal, according to Brazil’s Supreme Court, which authorized the arrests.

Mr. Cerveró is accused of taking bribes in exchange for awarding supplier contracts as part of a massive graft ring that operated at Petrobras for more than a decade. Court documents portray the efforts by Messrs. Esteves and Amaral to free Mr. Cerveró from custody.

At a November meeting at an upscale Brasília hotel, Mr. Amaral met with Mr. Cerveró’s son, Bernardo Cerveró and two other men to discuss ways to free Mr. Cerveró from prison and have him flee the country, according to the documents.

According to the documents, Mr. Amaral proposed using a legal maneuver to secure Mr. Cerveró’s release from prison while he awaits trial.

Supreme Court Justice Teori Zavascki said that Mr. Amaral “is part of a criminal organization,” citing the senator’s alleged participation in “an escape plan” that could jeopardize the corruption probe known as Operation Car Wash.

The court documents didn’t expressly indicate a link between BTG and the investigation.

But Brazilian authorities have been investigating BTG’s $1.5 billion purchase of a 50% stake in the African operation of Petrobras in 2013 following allegations that the price paid the bank may have been too low.

BTG also is a major investor in troubled oil rig supplier Sete Brasil Participações SA, which also was ensnared in the Operation Car Wash investigation.

Mr. Esteves’s arrest is a dramatic setback for one the nation’s best-known financial executives. One of Brazil’s richest men, Mr. Esteves, 46, has a net worth estimated at $2.1 billion, according to Forbes.

Mr. Esteves quickly developed a reputation for innovative deal making and built BTG into Brazil´s largest independent investment bank, with 245 partners and 3,500 employees. The bank manages about $112 billion and has offices in 20 countries.