The U.K. will force its overseas territories, including some well-known corporate secrecy havens, to reveal the names of company owners in these locations.

The United Kingdom is to force its overseas territories, including the Cayman Islands, British Virgin Islands and other well-known corporate secrecy havens, to reveal the names of the ultimate owners behind companies in these remote locations.

The surprise move, which until Tuesday had not been supported by prime minister Theresa May’s government, is a victory for corporate transparency campaigners who have long claimed that offshore secrecy encourages and enables corruption, tax evasion, money laundering and other crimes around the world.

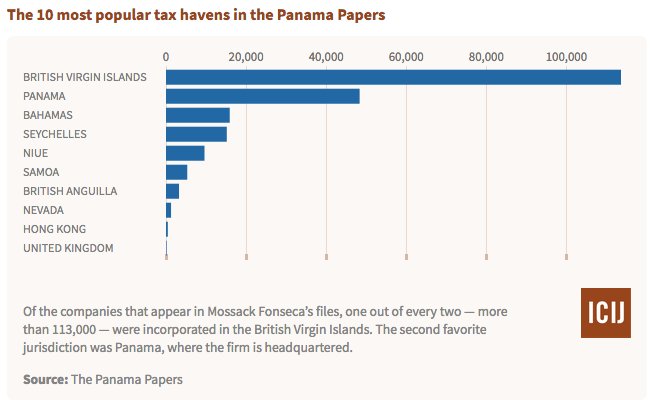

It comes two years after the ICIJ’s Panama Papers investigation showed one in every two companies found in Mossack Fonseca’s files — the controversial law firm at heart of the scandal — was incorporated in the BVI. Mossack Fonseca closed down in March.

Duncan Hames, of Transparency International UK, said “these jurisdictions have long been the Achilles’ heel of our defenses against dirty money.”

Global Witness, a nonprofit campaigner against corruption, said the U.K.’s intervention was “a huge win in the fight against corruption tax dodging and money laundering.”

Many campaigners credited investigative work by ICIJ, including the Panama Papers and the Paradise Papers, and its partners for highlighting controversial practices in the offshore world.

The U.K.’s 14 overseas territories also include Anguilla, Gibraltar, Bermuda, Montserrat and the Turks & Caicos Islands. Their constitutional relationship with the U.K. is slightly different to that of the Crown Dependencies of Jersey, Guernsey and the Isle of Man — none of which will be subject to the new rules…..icij.org