The Financial Stability Board (FSB) coordinates financial regulation for the Group of 20 economies and will finalize the rules by the end of September for endorsement by G20 leaders in November.

The FSB wants the top 30 banks to hold enough equity and long-term bonds so that if they fall into trouble they have enough resources without calling on taxpayers.

Major U.S. bank groups said in February the plan goes beyond what’s needed even at the lower end of the FSB’s range, but the calls appear to have been largely ignored.

“What we understand is that it will be going ahead largely as expected,” a senior banking industry source said.

“There will be tweaks here and there, but nothing substantial,” a G20 source added.

The buffer of “total loss absorption capacity” or TLAC would come on top of core capital requirements.

Standard & Poor’s has estimated that US$500 billion in bonds may have to be issued.

Mark Carney, the Bank of England Governor who chairs the FSB, has said the reform is crucial to ending “too big to fail” banks and drawing a line under the 2007-09 financial crisis.

Some banks like UBS and Bank of America have told analysts this month they are in a position to comply well ahead of the 2019 deadline, if not straight away.

“We’re going to start issuing TLAC in the current quarter, in 3Q, so we’re obviously not waiting to see the final regulations,” UBS Chief Financial Officer Tom Naratil told reporters on Monday.

“As we’ve indicated previously, it doesn’t really matter where it ends up, we feel that we’re well prepared to be able to address even the higher end of that band,” Naratil added.

Regulators in Continental Europe where some banks are still building up core capital cushions, want a final TLAC figure nearer 16 percent, while the Federal Reserve wants it around 20 percent, bankers said.

Settling for about 18 percent, as some bankers expect, will likely prompt the Fed to top this up with local requirements.

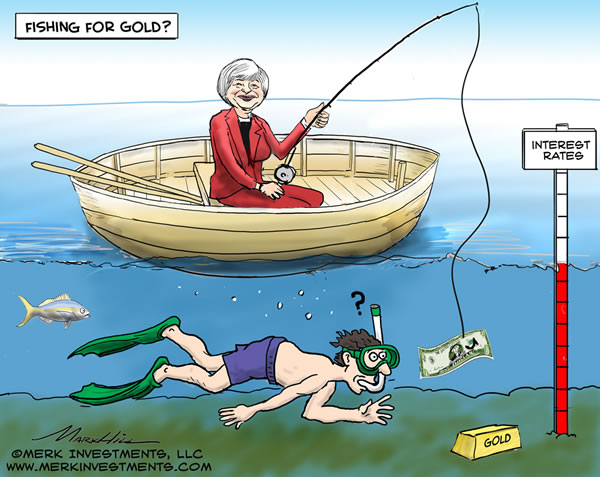

“Once the TLAC details have been finalised, the sector will be looking at how this is implemented in key jurisdictions, including whether any will gold plate,” said Oliver Moullin, a director at European banking lobby AFME.

The FSB, which had no comment, proposed that large banks from emerging markets like China be exempt from holding TLAC but bankers say the final rule will likely say this is temporary.

Banks with major units abroad must hold TLAC to reassure local regulators their taxpayers won’t be on the hook in a crisis. Under FSB proposals, these pools of TLAC could add up to well in excess of even 20 percent on a group basis.

“We have heard the FSB has found ways to mitigate that consolidation effect,” one senior European banker said.

Once a final TLAC figure is agreed, the banks will come under pressure to comply sooner rather than later, analysts said.

“I think banks will have to communicate as early as possible what their plans are to meet the requirements if they don’t meet them,” said Alexandre Birry, director, financial services ratings, at Standard & Poor’s.

SNL, a financial data company, said the next rung of lenders below the top 30 would also face investor pressure to meet the standards of the biggest players.