Carmen Reinhart writes: For the 189 countries for which data are available, median inflation for 2015 is running just below 2%, slightly lower than in 2014 and, in most cases, below the International Monetary Fund’s projections.

Most of the other half are not doing badly, either. In the period following the oil shocks of the 1970s until the early 1980s, almost two-thirds of the countries recorded inflation rates above 10%. According to the latest data, which runs through July or August for most countries, there are “only” 14 cases of high inflation (the red line in the figure). Venezuela (which has not published official inflation statistics this year) and Argentina (which has not released reliable inflation data for several years) figure prominently in this group. Iran, Russia, Syria, Ukraine, and a handful of African countries comprise the rest.

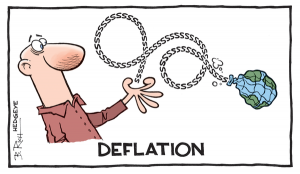

The risk for the world economy is actually tilted toward deflation for the 23 advanced economies in the sample, even eight years after the onset of the global financial crisis. For this group, the median inflation rate is 0.2% – the lowest since 1933.

While we do not know what might have happened were policies different, one can easily imagine that, absent quantitative easing in the United States, Europe, and Japan, those economies would have been mired in a deflationary post-crisis landscape akin to that of the 1930s.

Falling prices mean a rise in the real value of existing debts and an increase in the debt-service burden, owing to higher real interest rates. As a result, defaults, bankruptcies, and economic decline become more likely, putting further downward pressures on prices.

The 2.2% price decline in Greece for the 12 months ending in July – the most severe example of ongoing deflation in the advanced countries and counterproductive to an orderly solution to the country’s problems.

Median inflation rates for emerging-market and developing economies, which were in double digits through the mid-1990s, are now around 2.5% and falling. The sharp declines in oil and commodity prices during the latest supercycle have helped mitigate inflationary pressures, while the generalized slowdown in economic activity in the emerging world may have contributed as well.

But it is too early to conclude that inflation is a problem of the past, because other external factors are working in the opposite direction.

Given that most emerging-market countries’ trade is conducted in dollars, currency depreciation should push up import prices almost one for one.

At the end of the day, the US Federal Reserve will base its interest-rate decisions primarily on domestic considerations. While there is more than the usual degree of uncertainty regarding the magnitude of America’s output gap since the financial crisis, there is comparatively less ambiguity now that domestic inflation is subdued. The rest of the world shares that benign inflation environment.