The US is not the only country whose students are burdened by debt. More and more students are being forced out of colleges and universities in Japan because they cannot afford tuition. More and more students are asking for tuition exemptions and spit payments. Long term debt can be an intolerable burden. The educational system will create an unfair gap between the rich and the poor unless other methods of financing educaion are found.

Category Archives: Big Banks

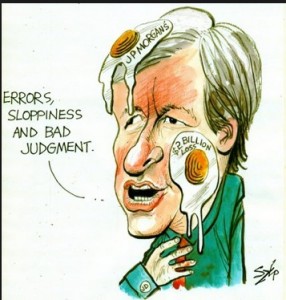

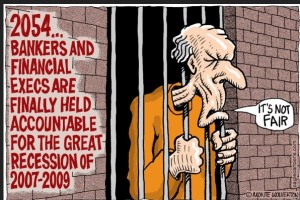

Bankers and Financiers Commit Crimes, Pay Peanuts for Them and Keep on Trucking

Rengan Rajaratnam settles insider trading charges. The Securities and Exchange Commission announced that former hedge fund manager Rajaratnam has agreed to pay more than $840,000 and accept securities industry bars in order to settle the agency’s insider trading case against him.

The SEC had filed charges against Rajaratnam for his role in the widespread insider trading scheme conducted by his brother Raj Rajaratnam and hedge fund advisory firm Galleon Management. The insider trading occurred in securities of more than 15 companies for illicit gains totaling nearly $100 million. The SEC has now obtained court judgments or settlements in Galleon-related enforcement actions against 35 defendants, resulting in approximately $165 million in monetary sanctions.

Rengan Rajaratnam, who became a portfolio manager at Galleon after co-founding hedge fund advisory firm Sedna Capital Management, neither admitted nor denied the SEC’s allegations in agreeing to the settlement that is subject to court approval. The proposed final judgment would permanently enjoin Rengan Rajaratnam from violating Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5, and require him to pay $372,264.42 in disgorgement, $96,714.27 in prejudgment interest, and a $372,264.42 penalty. Under the settlement, he also would be barred from association with any investment adviser, broker, dealer, municipal securities dealer, or transfer agent with the right to apply for reentry after five years. No jail sentences handed down. His brother is one of the few bankers to get time — eleven years.

Big Data Not Discriminatory?

Daniel Castro writes: Many individuals have made the claim that big data might lead to more discrimination, An online retailer might offer one price to Asian customers and another price to Latino customers This idea appeared in the White House big data review led by John Podesta, where the final report stated that “An important conclusion of this study is that big data technologies can cause societal harms beyond damages to privacy, such as discrimination against individuals and groups.” This idea was also the subject of a recent Federal Trade Commission (FTC) workshop exploring what FTC Chairwoman Edith Ramirez termed “discrimination by algorithm.” While this type of discrimination is plausible, there are many compelling reasons why it may never come to pass. Moreover, the focus on how big data might be used to harm individuals has overshadowed the bigger opportunity to use data as a new tool in the fight for equality.

One reason concerns about discrimination are likely overblown is because many laws, including the Americans with Disabilities Act (ADA), the Genetic Information Nondiscrimination Act (GINA), the Fair Credit Reporting Act (FCRA) and the Employee Retirement Income Security Act (ERISA), protect consumers from employers, creditors, landlords and others who may take adverse actions against them based on protected classes of information. Big data does not exempt businesses from following these laws. Earlier this year, for example, the FTC brought charges and entered into a settlement with Instant Checkmate for violating the FCRA.

Of course, just because a business might be able to create a racist or sexist algorithm, does not mean that it will do so. After all, most businesses are not actively seeking to discriminate against minorities, and in fact, many companies are actively championing a more inclusive worldview. Moreover, even where there are “bad apples,” companies face significant market pressure to not engage in such behavior, a lesson that most executives have probably learned following the swift departure of sponsors after the disclosure of former Los Angeles Clippers owner Donald Sterling’s racist remarks. Big data has not changed these factors.

But the bigger point is that the focus on preventing discrimination has diverted attention away from the bigger opportunity to use big data to create a more inclusive society. There are at least three ways this can happen. First, automated processes can remove human biases from decision-making. For example, while loan officers or apartment managers may discriminate, perhaps even unintentionally, on the basis of age or race, computers can be programmed to ignore these variables. Second, data creates feedback loops that encourage people to treat others as individuals. While some taxi drivers have notoriously refused to pick up passengers because of the color of their skin, apps like Uber allow drivers to decide whether to give someone a ride based on the passengers’ ratings, which are mostly tied to whether the riders are punctual and tidy. Third, data is a useful way to identify latent racism, such as discriminatory hiring practices or racial profiling by police. For example, data collected about the disparate impact of New York City Policy Department’s controversial stop-and-frisk policy has helped change opinions on the approach.

In short, not only are fears that big data will lead to discrimination in the future likely overblown, but they have clouded the debate. Those working to fight discrimination should look to data as a way to further eliminate unjust biases in society and create a more fair and transparent society.

European Central Bank May Buy Corporate Debt

Why would the European Central Bank buy corporate bonds? It may be that the market for asset backed securities and covered bonds in simply not large enough for the massive bond buying the ECB may do. They may have to acquire corporate debt as well.

This does raise the question of how buying debt of large corporations will do much to boost lending to smaller firms, a stated objective. And the corporations are not issuing a lot of bonds anyway.

Investigate NY Fed Supervision of Wall Street?

Whistleblower tapes revealed the weakness of the New York Federal Reserves oversight of Wall Street and big US banks. Senators Elizabeth Warren and Sherrod Brown call for investigation.

Warren and Brown, both members of the Senate Banking Committee, called for an investigation of the New York Fed after Carmen Segarra, a former examiner at the bank, released secretly recorded tapes that she claims show her superiors telling her to go easy on private banks. Segarra says that she was fired from her job in 2012 for refusing to overlook Goldman’s lack of a conflict of interest policy and other questionable practices that should have brought tougher regulatory scrutiny.

“Congress must hold oversight hearings on the disturbing issues raised by today’s whistleblower report when it returns in November, because it’s our job to make sure our financial regulators are doing their jobs,” Warren said in a statement on Friday. “When regulators care more about protecting big banks from accountability than they do about protecting the American people from risky and illegal behavior on Wall Street, it threatens our whole economy. We learned this the hard way in 2008.”

In an interview with This American Life and ProPublica, Segarra described numerous instances in which she said she alerted her bosses to questionable practices at Goldman. In one instance, she said she alerted a colleague that a senior compliance officer at Goldman had said that the bank’s view was that “once clients became wealthy enough, certain consumer laws didn’t apply to them.” Segarra claims that her New York Fed colleagues asked her to ignore the remark and change meeting minutes she had taken, which contained evidence of what the Goldman executive said.

New York Fed presdient WIlliam Dudley gently demanded a change of culture, but this won’t do the job. We need muscle behind bank reform.

Head of NY Fed Calls on Banks to Improve Culture

The head of the New York Federal Reserve Bank says that banks must improve their culture. Banks must change the way employees are compensated and take other steps to fix a corporate culture that encourages misdeeds or face being broken up, said William C. Dudley.

If bad behavior persists, “the inevitable conclusion will be reached that your firms are too big and complex to manage effectively,” Dudley said.

Dudley’s comments, which follow bank scandals involving Libor and foreign exchange trading, were made at a closed-doors workshop attended by senior bankers at the New York Fed on reforming Wall Street culture and behavior.

Lawmakers have enacted a major overhaul of the rules designed to prevent banks becoming “too big to fail.” Dudley said it was fair to question if the “sheer size, complexity and global scope of large financial firms today have left them ‘too big to manage.’”

Dudley, who has had to defend the New York Fed recently against allegations it was too soft on big Wall Street firms, suggested a number of ways to better align bank employee incentives with the interests of the general public. These include deferred compensation plans that switch emphasis to debt, rather than equity, and a centralized, industry-wide registry for tracking individual offenses.

Fines levied against banks could be paid out of deferred debt compensation of senior managers, which would play the role of a performance bond, Dudley said.

“This would increase the financial incentive of those individuals who are best placed to identify bad activities at an early stage, or prevent them from occurring in the first place,” he said, noting that since 2008, fines on big U.S. banks have exceeded $100 billion..

Dudley’s remarks followed a speech by Fed Governor Daniel Tarullo delivered at the same conference in which he said banks may face stiffer rules unless they improve their bad behavior.

“If banks do not take more effective steps to control the behavior of those who work for them, there will be both increased pressure and propensity on the part of regulators and law enforcers to impose more requirements, constraints and punishments,” Tarullo said.

Bad Ideas Linger on in Economic Policy

Barry Ritholtz writes about the consequences of holding on to bad ideas. There are none for the people who came up with them in the first place. Particularly think tanks just go blissfully forward.

Here are some ideas that have failed without sufficient notice: Profit maximizing economic actors, austerity as a virtuous policy during recessions, the efficient-market hypothesis, tax cuts pay for themselves, self-regulating markets.

ECOLEC report on Money Laundering and Crime

After the Third EC Directive to combat money laundering and terrorist financing came into force, the European Commission awarded Utrecht University the assignment to research the economic and legal effectiveness of the anti-money laundering and combating terrorist financing policy in the European Union (hereinafter ‘ECOLEF’). This research is performed within the European Commission, DG Home Affairs, on the “Prevention of and Fight against Crime” (ISEC) Programme. The ECOLEF team researches the policy of the 27 Member States of the European Union in relation to the mentioned topic, The ECOLEF project is headed by Prof. Dr. Brigitte Unger. Other members of the team are Prof. Dr. Henk Addink, Prof. Dr. Francois Kristen, Joras Ferwerda MSc., Ioana Deleanu MSc., Melissa van den Broek LLM, and Daan van der Linde MSc from Utrecht University, Ass. Prof. John Walker from the University of Wollongong, Australia, and Prof. Dr. Reinhard Pirker from Wirtschaftsuniversität Wien. Final ECOLEF report (digital version)_25.06.2013

US Creeps Closer to Women on the Presidential TIcket

Hillary Clinton has all but announced in the US, but signs from her campaigning for candidates in Southern states during the US 2014 election cycle are not promising. While her husband was first and foremost an economics specialist, she has not put forward any ideas for the economic future of the US. Tmidity may well characterize her Presidential run and even her Presidency if she makes it that far.

Elizabeth Warren is heading for Iowa, the state in which the first Preisidential primaries are held. A darling of progressives, she is really a centrist: work hard and play by the rules and you should succeed. An expert in banking, and fearless with her facts, she has put the banking industry that now controls US politics on notice. She probably can’t run. The US citizens experience with Obama’s inexperience will be used against her, but she would make a great VIce President.

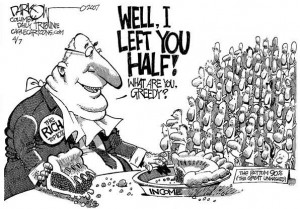

Inequality Needs to be Addressed

Mohamed A, El-Erian writes: There were quite a few disconnects at th International Monetary Fund and World Bank. Among the most striking was the disparity between participants’ interest in discussions of inequality and the ongoing lack of a formal action plan for governments to address it. This represents a profound failure of policy imagination – one that must urgently be addressed.

There is good reason for the spike in interest. While inequality has decreased across countries, it has increased within them, in the advanced and developing worlds alike. The process has been driven by a combination of secular and structural issues – including the changing nature of technological advancement, the rise of “winner-take-all” investment characteristics, and political systems favoring hte wealthy.

In the developed world, the problem is rooted in unprecedented political polarization, which has impeded comprehensive responses and placed an excessive policy burden on central banks. Though monetary authorities enjoy more political autonomy than other policymaking bodies, they lack the needed tools to address effectively the challenges that their countries face. Mohamed El-Erian writes: Among the most striking disconnect at the recent annual meetings of the IMF and the World Bank was the disparity between participants’ interest in discussions of inequality and the ongoing lack of a formal action plan for governments to address it.

While inequality has decreased across countries, it has increased within them, in the advanced and developing worlds alike. The process has been driven by a combination of secular and structural issues – including the changing nature of technological advancement, the rise of “winner-take-all” investment characteristics, and political systems that favor the wealthy.

In the developed world, the problem is rooted in unprecedented political polarization, which has impeded comprehensive responses and placed an excessive policy burden on central banks. Though monetary authorities enjoy more political autonomy than other policymaking bodies, they lack the needed tools to address effectively the challenges that their countries face.

In normal times, fiscal policy would support monetary policy, including by playing a redistributive role. But these are not normal times. With political gridlock blocking an appropriate fiscal response – after 2008, the United States Congress did not pass an annual budget, a basic component of responsible economic governance, for five years – central banks have been forced to bolster economies artificially. To do so, they have relied on near-zero interest rates and unconventional measures like quantitative easing to stimulate growth and job creation.

Beyond being incomplete, this approach implicitly favors the wealthy, who hold a disproportionately large share of financial assets.

As a result, most countries face a trio of inequalities – of income, wealth, and opportunity – which, left unchecked, reinforce one another, with far-reaching consequences. Indeed, beyond this trio’s moral, social, and political implications lies a serious economic concern: instead of creating incentives for hard work and innovation, inequality begins to undermine economic dynamism, investment, employment, and prosperity.

Given that affluent households spend a smaller share of their incomes and wealth, greater inequality translates into lower overall consumption..

It is time for heightened global attention to inequality to translate into concerted action. Some initiatives would tackle inequality directly; others would defuse some of the forces that drive it. Together, they would go a long way toward mitigating a serious impediment to the economic and social wellbeing of current and future generations. The Inequality Trifecta