Kaspersky Labs report on the billion dollarbank heist by hackers: The story of Carbanak began when a bank from Ukraine asked us to help with a forensic investigation. Money was being mysteriously stolen from ATMs. Our initial thoughts tended towards the Tyupkin malware. However, upon investigating the hard disk of the ATM system we couldn’t find anything except a rather odd VPN configuration (the netmask was set to 172.0.0.0).

At this time we regarded it as just another malware attack. Little did we know then that a few months later one of our colleagues would receive a call in the middle of the night. On the phone was an account manager, asking us to call a certain number as matter of urgency. The person at the end of the line was the CSO of a Russian bank. One of their systems was alerting that data was being sent from their Domain Controller to the People’s Republic of China.

Up to 100 financial instritutions have been hit.

When we arrived on site we were quickly able to find the malware on the system. We wrote a batch script that removed the malware from an infected PC, and ran this script on all the computers at the bank. This was done multiple times until we were sure that all the machines were clean. Of course, samples were saved and through them we encountered the Carbanak malware for the first time.Further forensic analysis took us to the point of initial infection: a spear phishing e-mail with a CPL attachment; although in other cases Word documents exploiting known vulnerabilities were used. After executing the shellcode, a backdoor based on Carberp, is installed on the system. This backdoor is what we know today as Carbanak. It is designed for espionage, data exfiltration and remote control.

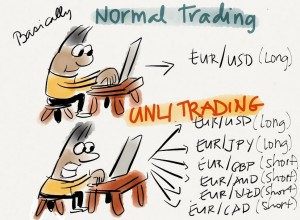

Once the attackers are inside the victim´s network, they perform a manual reconnaissance, trying to compromise relevant computers (such as those of administrators’) and use lateral movement tools. In short, having gained access, they will jump through the network until they find their point of interest. What this point of interest is, varies according to the attack. What they all have in common, however, is that from this point it is possible to extract money from the infected entity.

The gang behind Carbanak does not necessarily have prior knowledge of the inner workings of each bank targeted, since these vary per organisation. So in order to understand how a particular bank operates, infected computers were used to record videos that were then sent to the Command and Control servers. Even though the quality of the videos was relatively poor, they were still good enough for the attackers, armed also with the keylogged data for that particular machine to understand what the victim was doing. This provided them with the knowledge they needed to cash out the money.

During our investigation we found several ways of cashing out:

ATMs were instructed remotely to dispense cash without any interaction with the ATM itself, with the cash then collected by mules; the SWIFT network was used to transfer money out of the organisation and into criminals’ accounts; and databases with account information were altered so that fake accounts could be created with a relatively high balance, with mule services being used to collect the money.

Since we started investigating this campaign we have worked very closely with the law enforcement agencies (LEAs) tracking the Carbanak group. As a result of this cooperation we know that up to 100 financial institutions have been hit. In at least half of the cases the criminals were able to extract money from the infected institution. Losses per bank range from $2.5 million to approximately $10 million. However, according to information provided by LEAs and the victims themselves, total financial losses could be as a high as $1 billion, making this by far the most successful criminal cyber campaign we have ever seen.

Since we started investigating this campaign we have worked very closely with the law enforcement agencies (LEAs) tracking the Carbanak group. As a result of this cooperation we know that up to 100 financial institutions have been hit. In at least half of the cases the criminals were able to extract money from the infected institution. Losses per bank range from $2.5 million to approximately $10 million. However, according to information provided by LEAs and the victims themselves, total financial losses could be as a high as $1 billion, making this by far the most successful criminal cyber campaign we have ever seen.Our investigation began in Ukraine and then moved to Moscow, with most of the victims located in Eastern Europe. However thanks to KSN data and data obtained from the Command and Control servers, we know that Carbanak also targets entities in the USA, Germany and China. Now the group is expanding its operations to new areas. These include Malaysia, Nepal, Kuwait and several regions in Africa, among others.

The group is still active, and we urge all financial organizations to carefully scan their networks for the presence of Carbanak. If detected, report the intrusion to law enforcement immediately