UPDATE March 16, 2015: Individual ezperts who testitfed before the Labor Department’s hearing on a waiver for Credit Suisse have been asked to provide more documentation of proof that Credit Suisse has a culture of corruption. Very specific documentation was sent last week. No deicsion has yet been made on this matter. The CEO of Credit Suisse stepped down last wee, perhaps in part because Credit Suise wants to keep their $2 billioin in US pension funds management.

Last year Credit Suisse pled guilty to criminal charges to aiding and abetting tax evasion in the United States. Now a ‘criminal’ Credit Suisse was banned from continuing to operate 2 billion dollars in pension funds in this coutnry. They applied to the Labor Department for an extension, which they expected to be pro forma, In fact, a temporary exemption was granted.

Then Maxine Waters, a US representative from California cried out, Wait. Let’s take a deerper look at this. Let’s hold a public hearing.

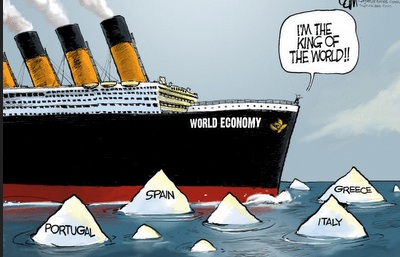

On January 15, 2015, the hearing was held. From Credit Suisse, the same old, same old was heard. Top executives knew nothing of these programs to aid and abet tax evaders. All the bad guys had been removed. But reporters in Switzerland, intimately familiar with Credit Suisse’s business practices, asked the obvious question: Is the culture of Credit Suisse so corrupt that under no circumstances should this exemption be granted?

Hard evidence from the European justice system suggests the answer to this question is: Yes.

Mr. Neil Radey, Managing Director, General Counsell-America, co-General Counsel-Investment Banking, Credit Suisse Securities (USA) LLC said: “Some commenters have alleged that senior management at Credit Suisse knew of the active assistance to U.S. customers evading taxes described in the plea agreement. These are claims that are unsubstantiated. Indeed, it was an independent investigation. It was conducted by external counsel, but it concluded that senior management was not aware of that misconduct.”

On November 21, 2011 a German district court ruling – file number10 KLs 14/11 – attested Credit Suisse to have instigated a large scale system to entice German citizens to evade taxes. The verdict further stated that Credit Suisse top management knew about this deliberate assault against the German revenue service. The court found that training materials were used to systematically train Credit Suisse staff to seek out German tax evaders. The verdict clearly confirmed that Credit Suisse’s top management had knowledge of the tax evasion crimes.

Neither the Credit Suisse internal tax investigation nor Credit Suisse top management reported any of the bank’s tax fraud found by the German Court to the US authorities.

Considering the German court’s unambiguous verdict against Credit Suisse, the fact that the bank’s senior management is still denying its knowledge about the tax evasion scheme and the fact that Credit Suisse is a repeat offender, Credit Suisse or its affiliates should not be given any exemptions. Credit Suisse’s statements do not have credibility.

Since Credit Suisse has not come clean with its criminal past, it is hard to understand how the Department of Labor can grant an exemption. The risk that Credit Suisse could continue to engage in criminal activities through its QPAM’s – as it has often done in the past — is far too great.