Category Archives: Big Banks

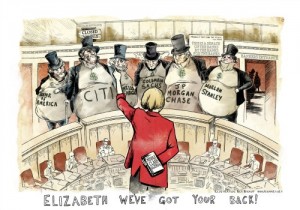

Warren Takes on the “I” in F.I.R.E.

Pam and Russ Martens write: In 2013, it was only because of Senator Warren that we learned that the so-called Independent Foreclosure Reviews to settle the claims of 4 million homeowners who had been illegally foreclosed on by the bailed out Wall Street banks were a sham. The “independent” consultants were hired by the banks, paid by the banks, and the banks themselves were allowed to determine the number of victims.

It was Senator Warren who put the high frequency trading scam described in the Michael Lewis book, “Flash Boys,” into layman’s language the American people could understand.

In 2013, Warren, together with Senators John McCain, Maria Cantwell and Angus King, introduced the “21st Century Glass-Steagall Act.” Warren explained why the legislation is critically needed:

“By separating traditional depository banks from riskier financial institutions,” said Warren, “the 1933 version of Glass-Steagall laid the groundwork for half a century of financial stability. During that time, we built a robust and thriving middle class. But throughout the 1980’s and 1990’s, Congress and regulators chipped away at Glass-Steagall’s protections, encouraging growth of the megabanks and a sharp increase in systemic risk. They finally finished the task in 1999 with the passage of the Gramm-Leach-Bliley Act, which eliminated Glass-Steagall’s protections altogether.”

Nine years later, the financial system crashed, leaving the economy in the worst condition since the Great Depression.

Last December, Warren made headlines again, stepping onto the Senate floor to reveal to the American people how Citigroup, the bank that received the largest taxpayer bailout in the history of the country after it imploded from its own derivatives bets in 2008 – had just slipped language into the spending bill to overturn part of the Dodd-Frank financial reform bill meant to rein in that behavior going forward. Despite her pleas, the bill passed both houses of Congress and was signed into law by President Obama.

Today, Warren is under fire by the “I” in F.I.R.E. – the insurance industry. On April 28, she sent letters to 15 insurance companies, including AIG, the international insurance company that blew itself up in 2008 by taking on the risks of Wall Street’s credit default swap bets and was bailed out with $182 billion from taxpayers.

The letters asked the insurance companies to provide Warren with the specifics on the incentives they offer to push the sale of annuities, the number and value of the incentives awarded, and the companies’ policies for disclosing these potential conflicts of interest. The letters were sent to the 15 companies with the highest 2014 annuity sales to individuals: Jackson National Life, AIG Companies, Lincoln Financial Group, Allianz Life, TIAA-CREF, New York Life, Prudential Annuities, Transamerica, AXA USA, MetLife, Nationwide, Pacific Life, Forethought Annuity, RiverSource Life Insurance, and Security Benefit Life.

What Would Happen if Women Were the Financial Regulators?

William Greider asks: If women were in charge of banking regulation, could they save us from the Wall Street cowboys who crashed the global financial system?

That provocative question was the implicit subtext for an all-day conference of banking and financial officials in Washington this week, held at, of all places, the soberly serious International Monetary Fund. The IMF’s managing director, as it happens, is a woman—Christine Lagarde of France—and she appeared alongside an even more powerful woman—Janet Yellen, chair of the US Federal Reserve System. Neither of them was in charge when the system crashed in 2008.

The IMF event was not a rump rally of feminists who somehow crashed the halls of power. But all of the 18 speakers on various panels were women, prominent as bank regulators or financial authorities. The one-sided gender line-up was not exactly an accident. The men in suits could hardly miss the message.

But just in case they did, IMF Director Lagarde prompted them with a droll question: “What would have happened if Lehman Brothers had been Lehman Sisters?”

What she meant was that different values might have prevailed if women had held the controlling positions at the brokerage or were the government regulators enforcing prudent standards. Women, as Lagarde has observed, worry more about financial exclusion. Worldwide, 42 percent of women have no access to financial services. Only a measly 3 percent of bank CEOs are women.

More to the point, Largarde said research shows women are more risk-averse—a quality utterly missing in the reckless banks and brokerages rushing like lemmings to the cliff. Women in charge might have asked tougher questions.

Fed Chairwoman Yellen stayed away from the gender question. But Lagarde has invoked “Lehman Sisters” numerous times since the financial collapse and disappointing recovery.

“It takes a great deal of will power to direct the French economy,” Largarde wrote in 2010 when she was France’s finance minister. “I am not doing this for women but as a woman I am, perhaps, more keenly aware of the damage that the crisis has done through greed, pride and a lack of transparency…. I am determined to do everything within my power to change the rules of the game and do my best to ensure that a crisis such as this can never happen again.”

What women want, she wrote, is to be judged, like men, on the basis of their deeds. She added what Eleanor Roosevelt had to say on the subject. “A woman is like a tea bag—you never know how strong it is until it’s in hot water.”

One of the conference speakers, Brooksley Born, is a courageous example. Born was nearly drowned by “hot water” dumped on her by Robert Rubin, Alan Greenspan, and Larry Summers during the Clinton administration. As a regulator she was trying to impose some limits on dangerous derivatives. The men hammered her, blocked her, and effectively drove her out of government.

Institute for New Economic Thinking was co-founded and funded by investor George Soros and others, and it set out to sweep worldwide in search of new ideas and new economists who are breaking free of the old orthodoxy that failed.

Johnson was once asked,“If you could wave a magic wand and do one thing to make the financial system better, what would it be?” Johnson had a quick answer: “Only women get to regulate finance.”

Connect Bankers’ Salaries to Performance?

Banks need to do more to shake up bonus-heavy pay structures and attack corporate cultures that encourage excessive short-term risk-taking, the head of the International Monetary Fund warned yesterday.

Christine Lagarde, IMF managing director, said since the 2008 global financial crisis much had been done on the regulatory front to crack down on banks and bankers and avoid a repeat of the turmoil.

But in a speech in Washington she cautioned that risks to financial stability were still elevated and the “culture” of the financial sector was at least partly to blame.

She said pay practices needed to encourage the long-term performance of banks and other companies rather than short-term gains. Shareholders also needed to be given a bigger say on pay, while banks should have the power to claw back pay and bonuses in the event of misconduct or changes in performance, she added.

More also needed to be done to improve internal risk-management structures, she said, citing the case of JP Morgan’s “London Whale”, in which a trader at the bank ran up $6 billion in trading losses. In that case, “financial risks were either ignored or underestimated . . . Failure happened at both the management and board levels.”

“Regulation alone cannot solve the problem,” she said. “Whether something is right or wrong cannot be simply reduced to whether or not it is permissible under the law. What is needed is a culture that induces bankers to do the right thing, even if nobody is watching.

“Ultimately, we need more individual accountability. Good corporate governance is forged by the ethics of its individuals.”

Regulators around the world have since the crisis placed an increasing emphasis on conduct and risk-management issues amid concerns that banking scandals could trigger new systemic risks.

Addressing the same event as Ms Lagarde, she cited tougher rules governing capital and liquidity requirements and said the Fed had made improved risk management and internal controls at companies a “top priority”. Lax controls contributed to “unethical and illegal behaviour” by banks and employees, she said.

Yellen on Finance and Society

She also noted that the Fed was watching the issue closely.

“I would highlight that equity market valuations at this point generally are quite high,” Yellen said, according to Reuters. “There are potential dangers there.”

Yellen also made note of the risks to open-ended mutual funds, Reuters reported, particularly dangers to liquidity if redemptions rose.

Banking regulators are remaining “watchful” for any areas where further reforms may be needed, she said in remarks at a financial conference.

Yellen cited the need to address the problem of “too big to fail”—the perception among investors that some institutions are so large that the government will step in and save them if they get into trouble.

She said the Fed and other regulators are taking steps to make sure that the collapse of even very large banking institutions can be handled in ways that don’t jeopardize the stability of the entire system.

Yellen’s comments came in a joint appearance with International Monetary Fund Managing Director Christine Lagarde at a conference sponsored by the Institute for New Economic Thinking.

Lagarde told the group that a recent IMF report found that risks to financial stability around the globe are rising with increasing risks at non-bank financial institutions and in emerging market countries.

“We need to build a financial system that is both more ethical and oriented more to the needs of the real economy—a financial system that serves society and not the other way around,” Lagarde said.

Yellen said a well-functioning financial sector promotes job creation, innovation and economic growth but that problems arise when the incentives become distorted, prompting bank executives to pursue risky strategies to increase profits.

“Unfortunately, in the years preceding the financial crisis, all too many firms took on risks they could neither measure nor manage,” she said.

“The result was the most severe financial crisis and economic downturn since the Great Depression,” the Fed chief said, noting that 9 million American lost their jobs and roughly twice that many lost their homes.

Cronyism Greases the Wheels?

Jonathan Rausch writes:

- Government cannot govern unless political machines or something like them exist and work, because machines are uniquely willing and able to negotiate compromises and make them stick.

- Progressive, populist, and libertarian reformers have joined forces to wage a decades-long war against machine politics by weakening political insiders’ control of money, nominations, negotiations, and other essential tools of political leadership.

- Reforms’ fixations on corruption and participation, although perhaps appropriate a long time ago, have become destabilizing and counterproductive, contributing to the rise of privatized pseudo-machines that make governing more difficult and politics less accountable.

- Although no one wants to or could bring back the likes of Tammany Hall, much can be done to restore a more sensible balance by removing impediments which reforms have placed in the way of transactional politics and machine-building.

- Political realism, while coming in many flavors, is emerging as a coherent school of analysis and offers new directions for a reform conversation which has run aground on outdated and unrealistic assumptions.

Rauch also explores possible realist solutions, such changes to campaign finance laws, congressional earmarks, primary elections, and transparency rules.

Putting the Community Back in Banking

Victoria McCrane writes: Hundreds of community bankers in Washington, DC this week will be raising concerns with lawmakers about the stalled nomination of one of their own to fill an open seat on the Federal Reserve’s seven-member board of governors.

Nearly 1,000 small bankers are in town for a policy summit hosted by the Independent Community Bankers of America, a trade group, and will be meeting with members of Congress and regulators to press policy priorities, including the pending nomination of former Bank of Hawaii chief executive Allan Landon to fill one of two empty seats on the Fed board.

Senate Banking Chairman Richard Shelby (R., Ala.), whose panel must consider Mr. Landon’s nomination before it can get a full vote on the Senate floor, said he told the White House a couple of weeks ago he won’t schedule a hearing for Mr. Landon until the president nominates a candidate for the other open seat at the Fed.

“We’ll see if they come up with two, and we’ll see what we can do,” Mr. Shelby said Tuesday. “They’ve got another opening. You know, they’ve never been in a hurry,” he said of the administration’s speed on filling open Fed seats.

The delay does not appear fueled by any GOP objections to Mr. Landon himself. Republicans as well as Democrats had been pushing the White House to embrace a candidate with community banking experience and none has publicly raised any complaints about Mr. Landon’s background.

“As is standard when we have vacant positions, the White House is conducting a comprehensive search for experienced and highly qualified individuals,” a White House spokeswoman said about the other vacant Fed governor slot. “When we are prepared to make an announcement, we will do so.”

Mr. Shelby noted that Mr. Obama also has failed to nominate a vice chairman of supervision at the Fed, a new role created by the 2010 Dodd-Frank law to oversee the central bank’s significant regulatory powers. “We’ve asked them about [that vacancy] over and over. They ought to think about that too,” Mr. Shelby said.

ICBA is now pressing the White House to produce another Fed nominee as well as pushing the issue on Capitol Hill.

Community bankers lobbied for years to get someone who understands their point of view onto the Fed board, and enlisted the help of several members of Congress to press the White House. President Barack Obama’s nomination of Mr. Landon in January was seen as a major victory for small bankers.

Upping Equity Requirements for Banks?

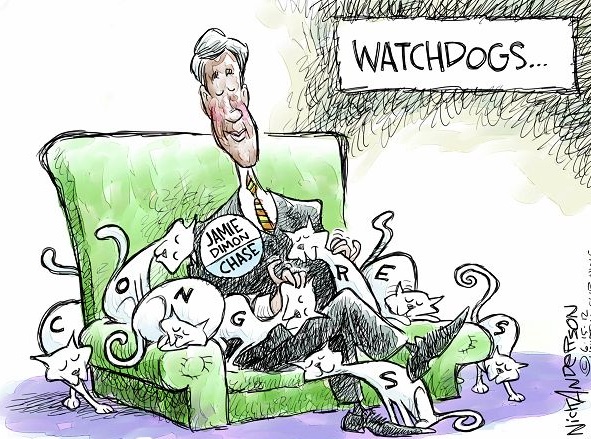

SImon Johnson writes: The main financial risk facing the United States today looks very similar to what caused so much trouble in 2007-2008: big banks with too much debt and too little equity capital on their balance sheets. Uneven global regulations, not to mention regulators who fall asleep at the wheel, compound this structural vulnerability.

All booms are different, but every major financial crisis has at its heart the same issue: major banks get into trouble and teeter on the brink of collapse.

The most important question to ask of any financial system is how much loss-absorbing equity major banks have on their balance sheets. When a company suffers losses, its shareholder equity falls in value, and less equity means that the company is more likely to default on its debts.

The capital ratios most frequently highlighted by banks and officials are misleading, because they include items – such as goodwill and deferred tax assets – that are incapable of absorbing losses. We need to look instead at tangible equity relative to tangible assets. And we should also be very careful about the accounting used for derivatives.

Thomas Hoenig, vice chairman of the Federal Deposit Insurance Corporation, publishes his own calculation of capital levels at the world’s largest banks, and these data are now available through the end of 2014. The most leveraged big US bank, Morgan Stanley, has less than 4% equity, meaning that 96% of its balance sheet is some form of debt. The average for big US banks is just under 5% equity.

This is more – but not much more – capital than some troubled banks had in the run-up to the financial crisis in 2008. Citigroup, for example, had no more than 4.3% equity, according to Hoenig’s calculation, in November 2008. At the end of 2012, when Hoenig started to publish his US GAAP-IFRS adjustment, the average for the largest US banks was roughly 4% equity. It is possible to argue that this key measure is moving in the right direction, but the pace of improvement is glacial at best.

More important, 5% equity is unlikely to be enough to absorb the kinds of losses that a highly volatile world will throw up.

The most dangerous shocks may be those that originate with the big banks themselves. The latest significant development to surface is what Better Markets, a pro-reform group that has put out a helpful fact sheet, calls “de facto guaranteed foreign subsidiaries” that trade derivatives – a murky phenomenon that likely involves all the big players. The trick here is that a de jure guaranteed foreign subsidiary of a US bank would have to comply with many US rules, including those governing conduct, transparency, and clearing (how the derivatives are actually traded). A foreign subsidiary that is supposedly independent is exempt from those rules.

The main reason why such loopholes are left open is that regulators choose not to close them. Sometimes this may be due to lack of information or awareness. But, in many cases, the regulators actually believe that there is nothing wrong with the behavior in question – either because they have been persuaded by lobbyists or because they themselves used to work in the industry (or could go work there soon.)

Sound familiar?

China and the US in the Global Economy?

Jeffrey Frankel writes: China and the United States seem to regard Asia-Pacific relations similarly: as a zero-sum game. Are countries signing up for China’s Asian Infrastructure Bank or America’s Trans-Pacific Partnership? Will China be welcomed, or humiliatingly rebuffed, in its effort to persuade the International Monetary Fund to include the renminbi in its unit of account, Special Drawing Rights (SDR)? Is the US still the world’s largest economy, or did China surpass it in 2014?

However tempting it may be to focus on such questions, they are the wrong way to think about the global economy. There is no reason why some countries should not join both China’s AIIB and America’s TPP, or why overlapping memberships should not expand over time – or, indeed, why the hostesses should not eventually attend each other’s parties.

There is nothing wrong with joining the AIIB. Asia needs more help with infrastructure investment than the World Bank and the Asian Development Bank can provide; China can play a useful leadership role; and the participation of countries with high governance standards can help prevent the cronyism, corruption, and environmental damage to which large-scale infrastructure projects are prone.

Likewise, the TPP negotiations are sometimes characterized as a US attempt to isolate China. But, given the Asia-Pacific region’s high trade volumes, and its dense set of trading arrangements running in every direction, no one, including China, is about to be isolated.

Exchange rates are another area where zero-sum thinking prevails.

Every five years, the IMF reconsiders its composition, which currently is defined in terms of the dollar, euro, yen, and pound. A misplaced focus on country rankings can do real damage.

Such is the case with the stalled IMF quota reform, an issue where the rankings in fact are of some importance, but not in a zero-sum way. quota shares, implying greater financial contributions and greater voting weights.

Thirty years ago, the West wanted nothing more than for China to become a capitalist economy. It has done so, with spectacular success. The rules of the game now require that China be given a bigger share in the governance of international institutions.

HSBC to Hong Kong?

HSBC proclaims that the world is its oyster.

HSBC Holdings Plc, less than two weeks before Britain’s general election, said it’s reviewing whether to move its headquarters out of the country because of rising tax and regulatory costs.

A move to Hong Kong, viewed by analysts as the bank’s most likely destination should it relocate, would unpick a structure that’s existed since the Hongkong and Shanghai Banking Corp. acquired Britain’s Midland Bank Plc in 1992. A transfer should cost no more than $1.5 billion because HSBC still has a base in the former British colony, said Chirantan Barua, an analyst at Sanford C. Bernstein Ltd. in London.

“The work is underway,” Chairman Douglas Flint told shareholders at the bank’s annual meeting in London on Friday. “The question is a complex one and it is too soon to say how long this will take or what the conclusion will be.”

“They may not like the U.K., but I’m not sure there’s exactly going to be a raft of people queuing up to have them” because of the size of HSBC’s $2.6 trillion balance sheet, said Edward Firth, head of European bank research at Macquarie Group Ltd. in London. “Hong Kong is the only serious possibility.”

In a statement, the Hong Kong Monetary Authority noted what it called HSBC’s “deep historical links” and said it would take a “positive attitude” should the lender decide to move.

Finance Director Iain Mackay said in an interview: HSBC won’t just look at Hong Kong, but other countries with a strong regulatory framework including Canada, the U.S., China, Australia, Singapore, France and Germany.

HSBC also said it’s concerned about Britain’s potential exit from the European Union.

Standard Chartered, another British bank that like HSBC makes most of its profit in Asia, is also being urged by investors to relocate because of the cost of being in London. The U.K. levy cost Standard Chartered $366 million last year, accounting for about 9 percent of its $4.2 billion of pretax profit.