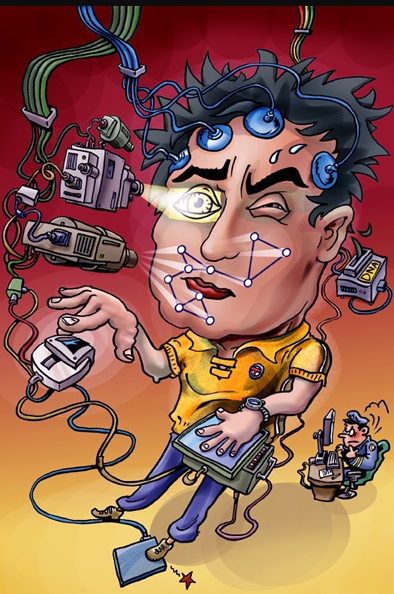

The use of biometrics to confirm identity is on the rise.

The Atlanta Fed reports: The use of physical characteristics to identify people – biometrics – is older than flying machines. Seeking a way to identify repeat criminal offenders so as to mete out harsher punishments, a police inspector in England in the 1880s devised a system of measuring criminals’ arms, heads, and other features. Then crime fighters began fingerprinting suspects a couple of decades later.

Today, a smart phone can have a fingerprint reader to prove you’re you when you make a payment over the phone. Consumers can now choose from more than a dozen “mobile wallets,” essentially payment mechanisms built into mobile phones. Numerous big technology and financial firms have rolled out payment apps that use biometrics. And many information security experts contend,that it is time to retire passwords as an authentication tool.

A boom in mobile payments and biometrics, long promised by industry boosters, could be dawning. That was among the themes that emerged from the Risk Forum’s November forum, “Banking on Biometrics: Bye-Bye Passwords?” The one-day forum explored the present and potential of biometrics as a verification tool for payments and banking.

Verifying a person’s identity generally encompasses some combination of three elements:

- Something you have (a payment card, for example)

- Something you know (a PIN or password)

- And something you are (your fingerprint, iris, and so on)

So far the first two have served the U.S. payments system reasonably well, Lott pointed out. Some of the technological advances are fascinating. Many sensors now include “liveness” detection. For instance, many facial recognition sensors require that you blink to be sure your face picture is real and not a three-dimensional mask, and advanced fingerprint readers detect blood flow.

Meanwhile, consumers have become more receptive to biometrics, Jain said. That growing level of acceptance seems to be evident in the marketplace. USAA, the first financial services firm to offer fingerprint, voice, and facial recognition for mobile banking apps, has garnered more than a million users for its biometric system.

And smart phone payment systems appear to be catching on. Jain said Apple Pay is supported by more than 300 banks, while Android Pay is accepted at more than a million stores.

“Biometrics are changing the way we conduct everyday transactions,” Jain said, “and now the focus is on payments.”

Nothing, including biometrics, promises 100 percent security. One of the keys to solid authentication, several conference speakers noted, is to figure ways to block imposters even if they have compromised biometrics, which sometimes can be done with photos or even 3-D masks on less-sophisticated systems.

The real key to biometrics becoming ubiquitous is straightforward: they must offer real security and be easy to use.