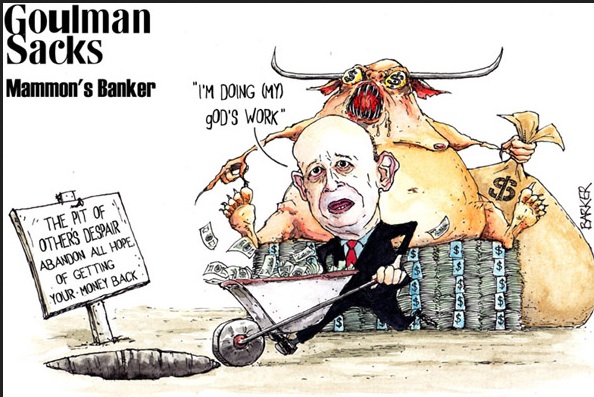

When sanctions against Libya were lifted, Goldman Sachs among others rushed in to take advanatage of the40 billion dollar investment opportunity offered by Libyan Investmnent Authority.

Now there is a court case in London which reveals that in exchange for $350 billion in fees, Goldman lost about a billion dollars of its cients’ dolllars.

Goldman claims this is a is not true. The Libyan Invesmtment Authority pleas financial illieracy

A high court judge has ordered Goldman Sachs to reveal how much profit it made on a deal that lost Libya’s government more than $1bn when financial bets turned sour.

The Libyan Investment Authority, created in 2006 to look after the country’s oil riches, accused the Wall Street bank of duping it into making investments that its “naive” staff didn’t understand.

A judge in the high court’s chancery division ordered the US investment bank to disclose how much money it had made on the deal. She asked Goldman to provide documents showing its profits on the disputed trades and how they were calculated.

Roger Masefield QC, acting for the Libyan investment fund, told the court that Goldman Sachs had made “substantial and unusually high” profits on the deal.

The dispute centres on nine financial products the Libyan sovereign wealth fund bought from Goldman Sachs in early 2008. These derivative investments were essentially bets on the future share price of a host of western companies, such as financial firm Citigroup and the energy group EDF.

The Libyan fund said it thought it was buying shares in the companies and alleges Goldman Sachs showered gifts on “naive” staff to induce them to buy products they didn’t understand. But Goldman argues the trades were not difficult for the fund’s “financially sophisticated” senior bankers to understand and has dismissed the claim as “a paradigm of buyer’s remorse”.

The case is proving to be an unwelcome spotlight on the workings of a Wall Street bank that prefers to keep a low profile.

The legal action against Goldman Sachs was launched in January, in the wake of new management being brought in at the sovereign wealth fund after the 2011 civil war, when Libyan dictator Muammar Gaddafi was toppled from power and killed.

As the loss-making deals of the Gaddafi era have come under the microscope, the fund has launched separate legal action against France’s third-largest bank, Société Générale, alleging bribery. It has rebutted the claims as without merit.