Charles Duxbury writes: A flickering revival in the Swedish inflation rate fizzled out in April, piling pressure on the central bank to cut interest rates to new record lows.

The Swedish statistics agency said the consumer price index fell 0.2% compared with April last year. That was below the 0.1% rise forecast of analysts.

The Swedish krona dived against the euro, which rose to 9.31 kronor from 9.25 kronor.

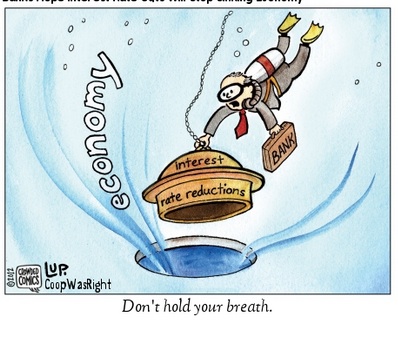

The central bank stands ready to act, even between scheduled meetings, to make monetary policy still more expansionary if the inflation outlook warrants it.

The Swedish central bank, the world’s oldest, already has a benchmark interest rate of minus 0.25% and has launched a bond-buying program.

The ECB bond-buying program is good for Sweden’s already fairly bright growth prospects in that it is helping the eurozone, a vital market for Swedish goods, to recover from a drawn-out downturn. But the program has also pushed down the value of the euro against the likes of the Swedish krona, making goods entering Sweden cheaper and choking off a vital source of inflation.

Rebecca Howard and Lucy Cramer writeL New Zealand’s central bank is now set to cut interest rates due to weak inflation and tough times for dairy farmers, with some economists calling for a reduction as early as June.

The view marks a dramatic shift: as recently as late April the majority of economists predicted the Kiwi central bank would remain on hold at 3.5% for the foreseeable future, making it something of an outlier in a region where interest rates have been coming down.y.

Annual inflation rose just 0.1% in the three months ended Mar. 31 and the central bank forecasts it won’t move toward the middle of the range until September 2016. Recent numbers, including weak first-quarter wage inflation data and softer-than-expected retail card spending, has added to view rate cuts might be coming.

Do we need a new approach to economic analysis?