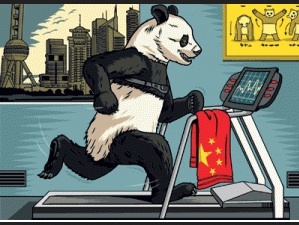

Justin Yifu Lin: China looks like the US, Europe and Japan after the Second Wolld War, when the growth rate exploded. In the 35 years China has been evolving into a market economy the growth rate exploed. Now it is slowing and evening out at about %7.75.

China has the potential to maintain robust growth by relying on domestic demand – and not only household consumption. The country suffers no lack of investment opportunities, with significant scope for industrial upgrading and plenty of potential for improvement in urban infrastructure, public housing, and environmental management.

Moreover, China’s investment resources are abundant. Combined central- and local-government debt amounts to less than 50% of GDP – low by international standards. Meanwhile, private savings in China amount to nearly 50% of GDP, and the country’s foreign-exchange reserves have reached $4 trillion. Even under comparatively unfavorable external conditions, China can rely on investment to create jobs in the short term; as the number of jobs grows, so will consumption.

The external scenario, however, is gloomier. Though developed countries’ authorities intervened strongly in the aftermath of the global financial crisis in 2008, launching significant fiscal- and monetary-stimulus measures, many of their structural shortcomings remain unresolved. “Abenomics” in Japan has yet to yield results, and the European Central Bank is following in the footsteps of America and Japan, pursuing quantitative easing in an effort to shore up demand.

Employment in the US is growing, but the rate of workforce participation remains subdued and the economy has yet to attain the 6-7% growth rates usually recorded in a post-recession rebound. The US, Europe, and Japan are likely to experience continued sluggish performance, inhibiting China’s export growth.