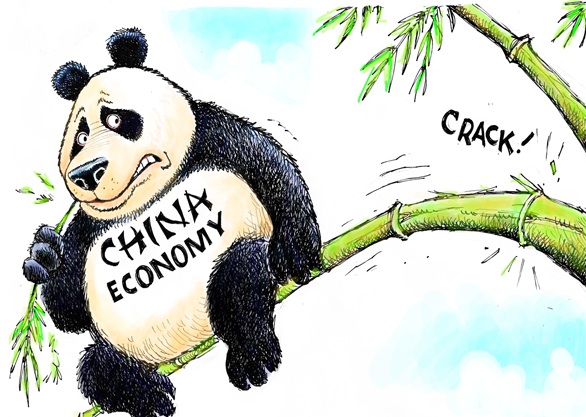

William Pesek writes: China has entered the global monetary-easing fray, along with more than a dozen other economies, after its central bank surprised investors by cutting reserve requirements 50 basis points to spur lending and combat deflation. But Beijing may be raring for an even bigger and more perilous fight in the currency market.

Reducing the amount of cash that banks are required to set aside (to 19.5 percent), as China has just done, is largely symbolic. Still, the move is also an inflection point. China is in all likelihood about to loosen monetary policy considerably to support economic growth. If global conditions worsen, China’s one-year lending rate, now at 5.6 percent, could head toward zero.

The central bank is devising measures to widen the band in which its currency trades. People’s Bank of China officials say it’s about limiting volatility as capital zooms in and out of the economy.

As China grapples with its slowest growth in 24 years, President Xi Jinping is under pressure to stimulate the economy. Yet that would run afoul of his pledges to curb runaway debt and credit (the latter jumped about $20 trillion from 2009 to 2014). What better way to gin up growth without adding to China’s bubbles than by sharply weakening the exchange rate?

Any significant drop in the yuan would prompt Japan to unleash another quantitative-easing blitz. The same goes for South Korea, whose exports are already hurting. Singapore might feel compelled to expand upon last week’s move to weaken its dollar. Before long, officials in Bangkok, Hanoi, Jakarta, Manila, Taipei and even Latin America might act to protect their economies’ competitiveness.

China may be feeling increased urgency as it looks around the Asia-Pacific region.

For China, Japan represents the biggest provocateur. The 30 percent drop in the yen under Prime Ministwe ShinzoAbe is slamming Chinese industry. Key beneficiaries of the policy such as Toyota and Sony (both projected huge profits this week) are lowering prices to gain market share abroad, effectively exporting deflation. Abe also gives Beijing political cover to devalue.

There’s obvious danger in so many economies engaging in this race to the bottom. It will create unprecedented levels of volatility in markets and set in motion flows of hot money that overwhelm developing economies, inflating asset bubbles and pushing down bond rates irrationally low.

Asia’s currency rivalries may be self-defeating. As Raghuram Rajan, governor of the Reserve Bank of India, said, “If you’re not increasing domestic activity but depreciating your exchange rate, you’re essentially drawing demand from the rest of the world.”

A competition to ease monetary policy is one thing. A currency war with the world’s biggest trading nation could turn into a crisis.