Can Caribbean banks function under the spotlight of regulators?

The Caribbean Association of Banks (CAB) has welcomed recent remarks by Christine Lagarde, Managing Director of the International Monetary Fund (IMF), over the problem of correspondent banks in the region de-risking and hopes that the organisation can help stop the current trend. As larger, mainly North American banks end their relationships with regional banks because of perceived regulatory risk and small profits, the banking sector across the Caribbean is getting increasingly concerned that the constant withdrawal of partner banks will destabilize all of its economies.

The problem came to the forefront in the Cayman Islands last summer when a number of local money transfer firms lost their relationships with their US banks, making it very difficult for the thousands of overseas workers here to remit earnings back to their native countries or for Caymanians to help their friends and family overseas with cash transfers.

But the de-risking is having a wider impact on Caribbean banking in general and Lagarde has described it as a “collective action problem that calls for a collective solution” as banks pull out of the region.

The CAB said that it has been raising the alarm about the effects on the Caribbean region for two years and has requested intervention over the loss of correspondent banking relationships that could render the Caribbean region “unbankable and ultimately destabilize all sectors of the economies”.

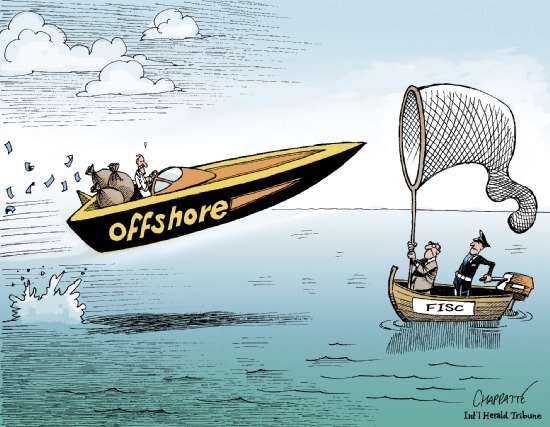

Among the many negative impacts anticipated from the disturbing trend of de-risking on small nation states is the risk of financial exclusion, a shrinking financial sector, thriving underhand economies, increased use of unregulated payment options and a barrier to attaining the Millennium Development Goal 10.

As was demonstrated by the enormous level of concern last summer from Jamaicans in Cayman who regularly send money home, that country is extremely dependent on remittances. The CAB said average remittances to Jamaica from overseas work accounts for 15% of the entire GDP.

Lagarde said, “Correspondent banking is like the blood that delivers nutrients to different parts of the body. It is core to the business of over 3,700 banking groups in 200 countries.”

While the CAB is hoping the IMF will come up with a solution, so far the private banking sector in North America in particular is still pulling out of the region, which the CAB said is putting the livelihoods of Caribbean people in serious danger.