Jean Claude Trichet writes: Banks and banking rely on trust. But while trust takes years to establish, it can be squandered abruptly if a particular bank’s ethics are weak, its values poor, and its behavior simply wrong.

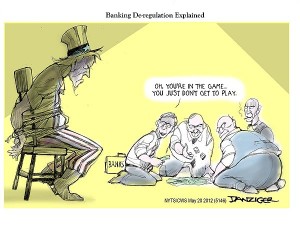

The events that triggered the 2008 global financial crisis, together with the subsequent scandals that have emerged – from the rigging of the London Interbank Offered Rate (Libor) to sanctions-busting and money-laundering – amount to a catalog of cultural failures within our financial institutions. Yes, extensive measures have been taken since the crisis to strengthen the financial system. But a profound weakness remains: To be blunt, it concerns the risk-taking culture that still prevails within some departments of global banks and in the financial system itself.

We fail to start our examination of banks with definition of what a bank is. A bank takes in other peoples’ money, which is why banks have to be regulated. They hold and invest that money. Earning 10-12 percent if considered reasonable. Banks now try to earn %25 percent. They simply can’t do that legally.

Too often, bank bosses’ promises to change the “corporate culture” and ensure their employees’ good conduct have not been matched by fully effective implementation. In too many cases, banks are still failing to fulfill their obligations in serving their communities and the public at large.

More regulation is not necessarily the best path forward: The rules and norms that define a “right” and “wrong” culture are beyond the wit of regulators and supervisory bodies It is not enough to strengthen legal compliance. Real change must go to the core of an institution’s day-to-day operations. Banks must change compensation practices that reward excessive risk; protect whistleblowers; recruit and train staff to reflect proper ethics; and ensure that their boards of directors play a more active oversight role.

Employees must understand instinctively what may be done and what should never be done. They must internalize a culture that values strict adherence to high ethical standards of conduct.

Banking regulators and supervisors also have a decisive role to play. They need to work with boards and senior management to ensure that major reforms are implemented and then consistently applied. Regular exchanges of views between oversight officials and the banks should be regarded as a crucial component of this process.