Elliot Wilson write: In a factory building wind turbines in China, workers have been given the day off. The factory, has not run at close to full capacity for a year.

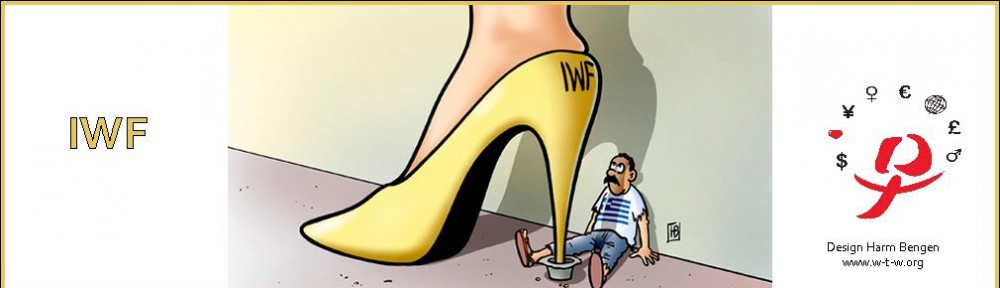

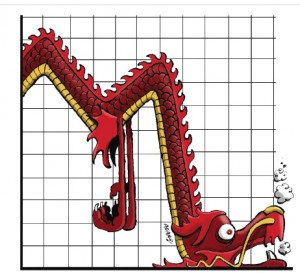

The company’s woes are a microcosm of the daunting challenges that face China’s stuttering economy, the world’s second largest after the United States. This week China devalued its currency by 3.6 per cent in a dramatic bid to encourage exports. Even the threat of a significant slowdown in China’s economy could be enough to send the rest of the world tumbling back into recession.

From the polluted central metropolis of Zhengzhou, to Shenyang in the rustbelt northeast, the overwhelming sense is one of pessimism and urban decay. Idle cranes and vacant building sites dot the landscape. The ghost towns of legend — such as Ordos City in Inner Mongolia — are all too real, and remain a silent, cautionary reminder of the perils of engineered growth.

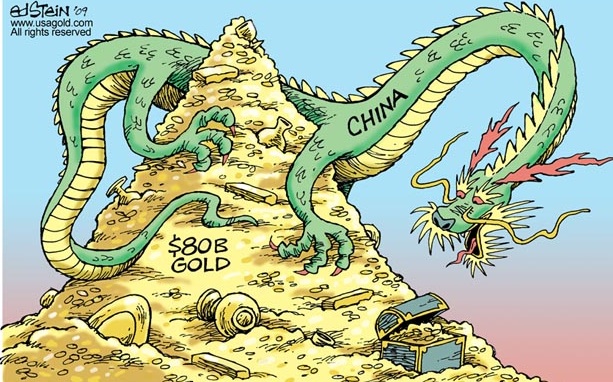

Over the past year, every key indicator has begun pointing to bad times ahead. Electricity consumption, usually the most reliable single gauge of economic health in the mainland, expanded at the slowest rate in three decades in the year to June. Because of falling Chinese industrial demand, global commodity prices have slumped, threatening growth in producer countries from Australia to Zambia. Chinese house prices have stagnated, while the last time rail-freight volumes were higher than the year before was last September. Last week brought yet more bad news, with exports sliding 8.3 per cent in July from last year’s figures, imports falling for the ninth month in a row, and data pointing to further weakness in industrial output, capital investment and retail spending. China’s Slowdown