A terrific TV series ended on September 29th, but is sold on Amazon and Netflix. For entrepreneurs it is worth a look. Three things help the show’s star, a chemistry teacher turn an insight into a flourishing business. The first is huge ambition. He is not in the “meth business” or the “money business”, he says. He is in the “empire business”. The second is product obsession. Other dealers might peddle “Mexican shoe-scrapings” on the ground that addicts care little about quality. He produces the king of meth, so pure that it turns blue, and would rather destroy an entire batch than let an inferior product be traded under his brand. The third is partnerships and alliances. He spots talent in a former pupil turned drug-dealer, Jesse Pinkman, and forms a strong working relationship with him. He also contracts distribution to a succession of local gangs so that he can concentrate on the higher-value-added part of the business: cooking and quality control. How do things turn out? TV Reflects an Entrepreneur’s Mirror image

Author Archives: Lily Fleur

Is 11 Bn and No Guilt Enough for Chase?

The exuberant entreprenurial spirit is at the heart of growth and the creation of wealth. But the brilliant economist Carmen Reinhart, writing with Kenneth Rogoff, has pointed out that this spirit leads to excessive risk-taking in good times. “This time is different” is never different. Exuberants think they can get a little more from the system, stay in for another month or two. No one heeds J. P. Morgan’s advice to sell early. The most recent subprime mortgage crisis was supported by two Federal Reserve chairman. True, we squelch exuberants at the cost of stagnation. But future manipulators of the financial system might do well to think about pricking the bubbles with J. P. Morgan’s timing skill. Now with have Chase trying to beat back the government’s criminal claims by paying an 11 billion dollar settlement with no admission of guilt. This simply is not a high enough penalty. The Chase Settlement Deal

Norway: The Ethics of Natural Resources

No one calls the Prime Minister of Norway a Chavez, but the country deals with natural wealth in very much the same way. It belongs to the country and should be used for the good of its people. How will this fly in Africa, a continent whose natural resources are abundant. Using A Country’s Natural Resources for the National Good

Apple Could Get Clobbered

Cash reserves, profits, but plummeting shares, Apple is not the same Apple it was five years ago. Henry Blodget, who has experienced disgorgment, speculates on Apple’s greed in pricing and how it may impact on the company’s future. Apple Could Get Clobbered

Women Are Leaving Wall Street. Why?

A fascinating article by Margo Epprecht analyzes why. Everyone now understands the game of institutionalized risk and individual rewards. New regulations mean to control risk. Even the smartest man in the room, Jamie Dimon, lost track of his profit and loss statement in the spring of 2012. The attributes that women (and many men who’ve been marginalized by the Wall Street culture) bring to the table; collaborative decision-making, a desire for more information, “common sense,” and high sensitivity to risk—are all traits allegedly in demand. Wall Street excess and its powerful protection of its own interests almost killed the financial system. Yet when it seems most imperative that the culture of Wall Street change, for the sake of the economy even, entrenched interests remain strong and resistant to change.

Reminded of her work habits from the early 1980s, Maryann Keller now laughs. “I thought I was going to die,” she says. “It was so crazy. If you think about it, we had barely any technology. You were literally locked on the phone the entire day.” Keller had to step back from her frenetic pace by the mid-1980s, briefly going into money management before joining Furman Selz for a satisfying dozen years building her expertise and network even further. Married for a second time, and adoptive mother to three grown children, Keller remains deeply involved in business, running her own consulting company, Maryann Keller and Associates, and serving on boards of companies and non-profits. But she thinks Wall Street is now less appealing to women. “The business has changed,” she muses, “It is not as intellectually challenging as it used to be. It’s more like cage fighting. Long-term investment today means a month; mathematicians convince themselves they can quantify risk in their arcane products that no one can understand; and fee structures are out of line with investor returns. No wonder people are cynical about Wall Street.” Why Women Are Leaving Wall Street

Best Companies in US for Female Executives

What is the primary reason women like working for these companies: They get to make the decision about what’s best for the company and its’ products. Top Companies for Female Executives

Entrepreneurs: Finding Value No One Else Sees

David Isenberg has written a fascinating book on entrepreneurs. Interestingly, he does not limit an entrepreneur to the innovation of an idea, but rather to the discovery of some unexplored niche that might satisfy human needs and desires. He also shows us why the entrepreneurial temperament is necessary for startups. We will synopsize the book in four articles over the next week. But ii is a great read if you have the time. Entrepreneurs

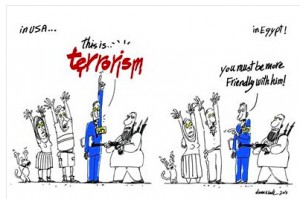

Doaa ElAdl, An Important Cartoonist on the Front Lines in Egypt

Doaa El Adl worked as a cartoonist for the newspaperAl Dostor, Rose Al Youssef Magazine, and Sabah El Kheir Magazine. She currently works at the prominent newspaperAl Masry Al Youm. She has also worked as an illustrator and has contributed to the magazines Qatr El Nada, Alaa-El Din and Bassem. In 2009 she was the first woman to win the Award of Journalistic Distinction in Caricature. Here is a recent interview with her in Sampsonia. A recent interview of Doaa El Adl by Olivia Stransky for Sampsonia

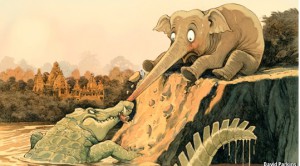

India’s Problems

The calamity of 1991 led to liberalising reforms that ended decades of stagnation and allowed a spurt of fast growth in Inda. This latest brush with disaster could produce a positive legacy, too, but only if it persuades voters and the next government of the importance of a new round of reforms that deal with the economy’s flaws and unleash its mighty potential. Corruption is rampant. Global markets are jittery and this is an election year. India’s Problems

Have Hedge Funds Gone As Far As They Can Go With Speed?

Competing to go a millesecond faster than the rest of the pack may be a thing of the past. Established technology giants are now selling big data on home pries and social media. Are we edging back to more conventional investing? The Wall Street Journal report. Have Hedgefunds Gone As Far as They Can with Speed?