In fact, if the whole world is holding its breath before this pathetic game of the US elite; it’s not out of compassion, it’s to avoid being swept away in the fall of the world’s first power. Everyone is trying to free itself from American influence and let go of a United States permanently discredited by recent events over Syria, tapering, shutdown and now the debt ceiling. The legendary US power is now no more than a nuisance and the world has understood that it’s time to de-Americanise. US Laughing Stock of World Over Shudown

Author Archives: Lily Fleur

From Siberia to China to the US: The Long Reach of Money Laundering

Further details of the illegal lumbering going on in Russia’s Siberian forests led to a US raid of Lumber Liquidators in Virginia. As W-T-W has repeatedly pointed out, criminal evasions of the law impact disproportionately on women and children as currencies are diverted from schools and public institutions. Legitimate lumber businesses in the US cannot compete with the underworld. Environmental Groups in US Target a Money Laundering Web

Original reporting from frank-cs.org

Startups in Brazil with Government Support

With two major global events coming up — the 2014 World Cup and the 2016 Summer Olympics — now sounds like a good time for the Brazilian government to announce a startup accelerator program. The country’s Ministry of Science, Technology and Innovation is offering up to $78 million to entrepreneurs that apply to Start-Up Brasil for one of 100 slots. Selected participants will go through a business accelerator for six to 12 months. About one-quarter of available slots will go to foreign companies, but only if they plan to stay for a few years; the government will help them get visas.

Start-Up Brasil director Felipe Matos wasn’t a huge fan of the government when he started his own incubator, but when he was approached to run this project, he “thought that this would be a fantastic opportunity to do something for the Brazilian startup ecosystem.” He believes that businesses can take advantage of a shift towards those who can afford to choose entrepreneurship over other professions. Brazil is the second South American country to create this type of program; Chile began its version in 2010. StartUp in Brazil

Apply by November 19. 2013 startupbrasil.21212.com/

Changes in Wall Street and Deregulation: Salomon and Citibank

The banking industry has evolved into was an army of megabanks, such as Citigroup and JP Morgan. They have employees numbering in the hundreds of thousands, and a bureaucracy in place to manage their diverse businesses, which spanned the entire globe.

With so many employees and businesses, it was hard for many of the people working inside to feel any real sense of ownership of the firm.

The result? Investment banks turned into a loose confederation united not by the understanding that their risk was jointly owned, but by a common source of cheap money: bank deposits and government-subsidized debt. One Man’s View

Internationalization of the Rupee

India pushes for internationalization of the rupee. As trade expands like are looking for more settlement in rupees and also open up financial markets so that those who receive rupees can invest back in. Internationalizing the Rupee

An important report on internationalizing currency. Internationalization of Currency

Twitter Teaches Accounting 102

Earning before interest, taxes, depreciation and amortization is an often cited financial metric. But it didn’t include enough expenses for Twitter As they prepare for an IPO, Twitter has added stock-based compensation and non-GAPP net loss, making their bottom line look much better. Twitter Accounting

How Local Law Impacts on Entrepreneurs

The raisin growers in California establish quotas on how much of their crop can be taken to market. While some elements of entrepreneurship are the same the world over, paying attention to the way things are done locally is a crucial consideration in doing business in another country. How Many Raisins to Sell?

Status of Women Entrepreneurs Around the World

While each country has its own history and style of dealing with women entrepreneurs, some issues are universal: access to capital, open door policies, government support among them. Julie R. Weeks, head of Womenable, works with American Express to prepare studies of the progress women have made. Her work is indispensable for entrepreneurs. Women Owned Businesses

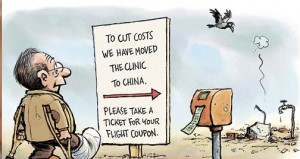

Entrepreneurs, Small Businesses and Health Insurance

As the battle is waged in Washington over Health Care in the US, a country which pays more money for health than any other country in the world, and life expectancy is lower than many less economically privileged countries, the status of small businesses and their obligations and responsibilities for their employees is tenuous. What makes sense? Small Business and Health Insurance

To Debt or Not to Debt: The US Conundrum

Consider the debt ceiling in the US. According to Goldman Sachs, without an increase in the ceiling, the Treasury would no longer be able to issue debt from October 17 and would deplete its cash by the end of the month. Much confusion exists about what would happen if the Treasury ran out of cash and could not increase its outstanding debt. The optimistic view is that it could meet its priorities, including debt service, by managing its payments. If so, no default need occur. Jack Balkin of Yale University argues just this. The pessimistic view is that managing its cash flows in such a way would be illegal and possibly impossible – not least because cash receipts fluctuate substantially. But the Treasury, playing a game of chicken, would argue the pessimistic case even if it believed it could cope.

At best, a failure to raise the debt ceiling would necessitate a sharp cut in spending. At worst, the US would default. Analysts at Bank of America Merrill Lynch argue that hitting the ceiling would require the US to balance its budget at once, cutting spending by about 20 per cent, or 4 per cent of GDP. That would push the US into another recession – even if there were no default. The consequences of an actual default, particularly one that lasted for some time, are beyond prediction. Unlike a shutdown, there is no precedent, for good reason. The notion is suicidal. To Debt or Not to Debt, That is the Question from Martin Wolf in the Financial Times.