Herzlinger, the first women tenured at the Harvard Business School, hopes that team-based learning will also address the huge attrition rate of online students. According to a study HarvardX and MITX conducted on their 2012-13 online offerings, 95 percent of students dropped out before earning a completion certificate. “When students are on teams, they become much more committed to both each other and the class,” she says.

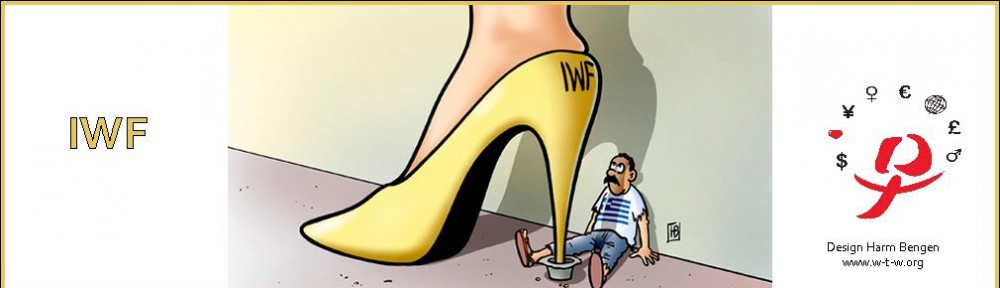

Drop out rates are high in online learning. A woman’s intuition is that getting to know your fellow students will help. Combining eLearning and eHarmony for an MBA