At the Commission on Crime Prevention and Criminal Justice (CCPCJ) in April 2013, the heads of two United Nations bodies had called on countries to recognize wildlife and forest crimes as a serious form of organized crime and strengthen penalties against criminal syndicates and networks profiting from such illegal trade.

If wildlife and forest offences were treated as serious transnational organized crimes the above acts could be treated as predicate offences. The buyers in China and the US could be accused of Money Laundering.

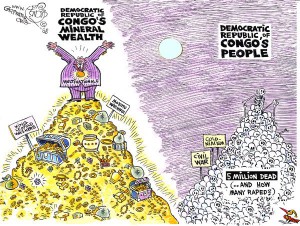

Today, rogues cut down timber in Siberia and sell the timber to China. China may or may not refine the timber, which is then sent to the US. Prices for this lumber in the US are lower than any legitimate businessman can charge. So the tainted lumber is undercutting legitimate businesses.

Publicly available information from NGOs’ reports and press articles can be prolific sources for suspicious ML/FT activities.

The act – which carries criminal penalties of up to $500,000 per violation – was amended in 2008 to include wood types to curb illegal logging.

Liquidating the Forests. Hardwood Flooring and Organized Crime