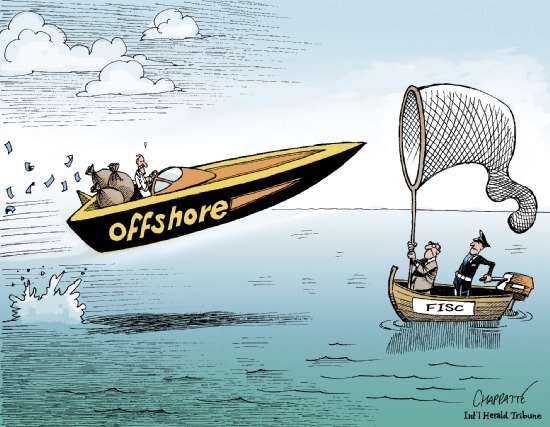

Russia’s central bank has withdrawn the licences of two small Moscow-based banks, part

Банк России

of its widening campaign to clean up the banking system and crack down on money laundering.

Russia has more than 900 banks, mostly small, and many are suspected of servicing the shadow economy. Since taking up her position as central bank head last year, Elvira Nabiullina, has made it clear she wants to tighten banking supervision and shore up large-scale capital flight to boost the flagging economy.

The central bank it had withdrawn Eurotrust bank’s licence because of a failure to meet obligations to its creditors and depositors, and to create sufficient reserves to cover potential losses on loans.

LINK Bank also failed to create provisions against risk and both banks were involved in “dubious operations”, such as money laundering, the central bank said in a statement.

Both banks are part of Russia’s system of retail deposit insurance, under which the state guarantees small savings if a bank fails. Last year, the withdrawal of Master Bank’s licence cost the state about 30 billion roubles ($890 million).

CBR Eurotrust Statement

CBR_LinkBank_Statement

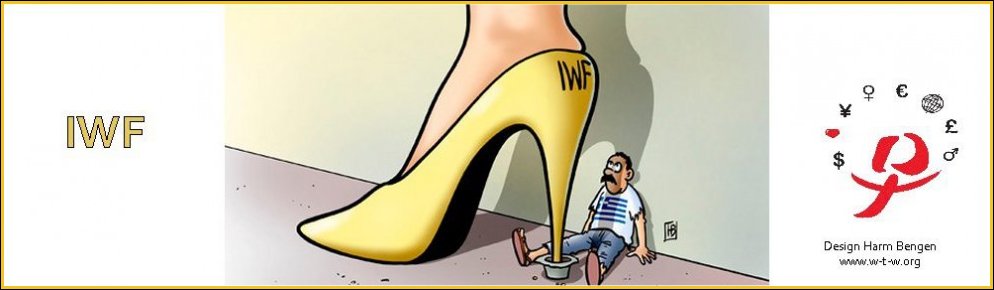

As I am just returning from Sydney’s G-20 meeting, I would like to share with you our views on the global economic situation. While unemployment is too high, public and private debt are too high, and global growth is too low relative to potential, we certainly see some economic momentum in the works—global economic growth of 3¾ percent this year, rising to 4 percent next year. This latest pickup of growth is largely due to positive developments among the advanced countries—certainly in the US, but also in Japan and the Euro Area.Innovation, Technology and the 21st Century

As I am just returning from Sydney’s G-20 meeting, I would like to share with you our views on the global economic situation. While unemployment is too high, public and private debt are too high, and global growth is too low relative to potential, we certainly see some economic momentum in the works—global economic growth of 3¾ percent this year, rising to 4 percent next year. This latest pickup of growth is largely due to positive developments among the advanced countries—certainly in the US, but also in Japan and the Euro Area.Innovation, Technology and the 21st Century