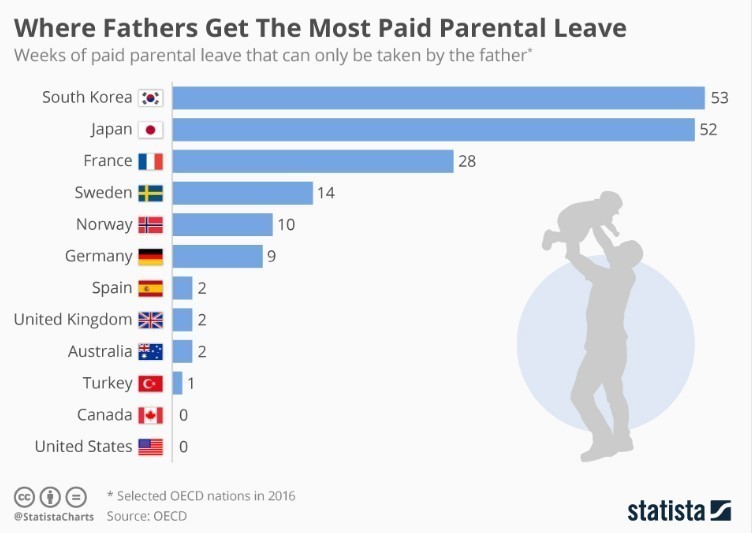

It’s no coincidence that movies like “Wall Street” and “Wolf of Wall Street” paint the finance industry as testosterone laden, especially on the trading floor of the New York Stock Exchange. While the U.S. financial services industry employs many women, according to a recent survey conducted by Catalyst, representation in financial services senior leadership roles remains low. Women made up only 35.9 percent of CEOs and executive level positions of Fortune 500 companies…..The Global Gender Gap Report 2 017

Author Archives: Diana Latona

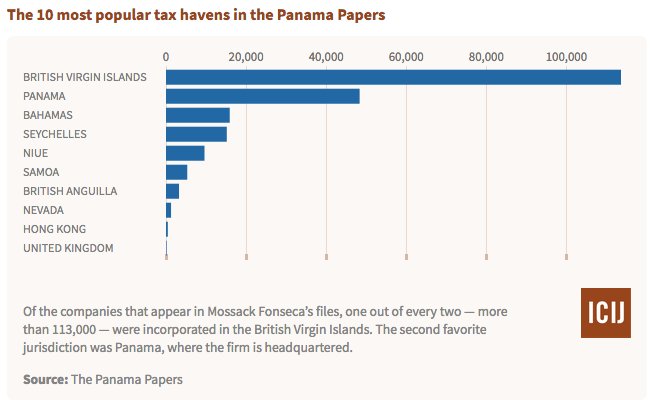

Most Popular Tax Havens in the Panama Papers

The U.K. will force its overseas territories, including some well-known corporate secrecy havens, to reveal the names of company owners in these locations.

The United Kingdom is to force its overseas territories, including the Cayman Islands, British Virgin Islands and other well-known corporate secrecy havens, to reveal the names of the ultimate owners behind companies in these remote locations.

The surprise move, which until Tuesday had not been supported by prime minister Theresa May’s government, is a victory for corporate transparency campaigners who have long claimed that offshore secrecy encourages and enables corruption, tax evasion, money laundering and other crimes around the world.

It comes two years after the ICIJ’s Panama Papers investigation showed one in every two companies found in Mossack Fonseca’s files — the controversial law firm at heart of the scandal — was incorporated in the BVI. Mossack Fonseca closed down in March.

Duncan Hames, of Transparency International UK, said “these jurisdictions have long been the Achilles’ heel of our defenses against dirty money.”

Global Witness, a nonprofit campaigner against corruption, said the U.K.’s intervention was “a huge win in the fight against corruption tax dodging and money laundering.”

Many campaigners credited investigative work by ICIJ, including the Panama Papers and the Paradise Papers, and its partners for highlighting controversial practices in the offshore world.

The U.K.’s 14 overseas territories also include Anguilla, Gibraltar, Bermuda, Montserrat and the Turks & Caicos Islands. Their constitutional relationship with the U.K. is slightly different to that of the Crown Dependencies of Jersey, Guernsey and the Isle of Man — none of which will be subject to the new rules…..icij.org

Big Data Means Big Business

Latest since Edward Snowden we know we have to protect our data.

Big Data could mean big business also for retailers.

Christian Baumann reports: Today’s retailers know their customer better than ever before. They understand who they are, what they buy, when they buy, how they like to pay, and what they think of a product or brand. Every customer visit and touch point, be it in the store, online or on a mobile device, produces a stream of data for the retailers to explore.

Big data analytics has become a vital tool in all aspects of the retail sector and offers incredible customer insight and understanding for retailers to explore in order to make their business more transparent and commercially successful…Globalbankingandfinance

YouTube is improperly collecting children’s data, consumer groups say

Beyond Facebook: It’s High Time for Stronger Privacy Laws

Data protection in the EU

Fundamental rights data-protection- EU

The EU Charter of Fundamental Rights stipulates that EU citizens have the right to protection of their personal data.

How Effective Is The Ukraine Tackling Money Laundering And Terrorist Financing?

This report provides a summary of the anti-money laundering (AML) and countering the financing of terrorism (CFT) measures in place in Ukraine as at the date of the on-site visit (between 27 March and 8 April 2017). It analyses the level of compliance with the Financial Action Task Force (FATF) 40 Recommendations and the level of effectiveness of Ukraine’s AML/CFT system, and provides recommendations on how the system could be strengthened.

This report provides a summary of the anti-money laundering (AML) and countering the financing of terrorism (CFT) measures in place in Ukraine as at the date of the on-site visit (between 27 March and 8 April 2017). It analyses the level of compliance with the Financial Action Task Force (FATF) 40 Recommendations and the level of effectiveness of Ukraine’s AML/CFT system, and provides recommendations on how the system could be strengthened.

Anti-money laundering and counter-terrorist financing measures Ukraine:

Fifth Round Mutual Evaluation Report

Latvian Bank Faces US Ban Over Money-Laundering Concerns

U.S. proposes sanctions on the Latvian ABLV Bank*

U.S. proposes sanctions on the Latvian ABLV Bank*

over money-laundering concerns. The U.S. is seeking to impose sanctions on ABLV Bank, the third largest financial institution in Latvia by assets, by prohibiting the bank from opening or maintaining a correspondent account in the United States due to money laundering concerns, the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) said on Tuesday…RIGA-Reuters

US treasury bans latvian bank over money-laundering concerns

According to Association of Latvian Commercial Banks, ABLV is the third largest bank in Latvia with assets of around 3.6 billion euros in September 2017.

ABLV NPRM 2018-02-12  * Currently, ABLV Bank, AS is the largest independent private bank in Latvia, having representative offices of the Group in many CIS countries. The bank’s controlling interest is held by Ernests Bernis and Oļegs Fiļs. The bank’s other shareholders include top management, employees, and the bank’s long-term partners and customers.

* Currently, ABLV Bank, AS is the largest independent private bank in Latvia, having representative offices of the Group in many CIS countries. The bank’s controlling interest is held by Ernests Bernis and Oļegs Fiļs. The bank’s other shareholders include top management, employees, and the bank’s long-term partners and customers.

ABLV Bank is a member of the Association of Latvian Commercial Banks, which protects interests of Latvian banks both in domestic and foreign markets, certifies banking specialists, and arranges professional seminars. Also, ABLV Bank takes active part in operations of other professional institutions, which aim at developing Latvia as regional financial centre.

Switzerland and US Ranked Most Financially Secretive

The Tax Justice Network released their Financial Secrecy Index, ranking Switzerland and the United States as the top two countries most attractive for tax evaders and money launderers. This is the second time in a row that the US has risen on the index, marking a fall in terms of transparency.

The Tax Justice Network released their Financial Secrecy Index, ranking Switzerland and the United States as the top two countries most attractive for tax evaders and money launderers. This is the second time in a row that the US has risen on the index, marking a fall in terms of transparency.

The Tax Justice Network just released their 2018 Financial Secrecy Index Switzerland and the United States were followed in the index by Hong Kong and the Cayman Islands, an autonomous British Overseas Territory. The index is unique in that it ranks countries based on a number of criteria, rather than creating a “blacklist” where countries are either labeled as tax havens or not.

According to a statement by the Tax Justice Network (TJN), the United States has moved up in the rankings because it “refuses to take part in international initiatives to share tax information with other countries, and has failed to end anonymous companies and trusts”.

OCCRP.org

Please click here to access the interactive overview map:

Financialsecrecyindex.com

Watch Live- WEF

World Economic Forum Annual Meeting

Creating a Shared Future in a Fractured World

The global context has changed dramatically: geostrategic fissures have re-emerged on multiple fronts with wide-ranging political, economic and social consequences. Realpolitik is no longer just a relic of the Cold War. Economic prosperity and social cohesion are not one and the same. The global commons cannot protect or heal itself. @WEF

W-T-W.org Women and Finance Cartoon of the Year 2017

Dagmar Frank announces the winner of W-T-W.org Women and Finance Cartoon of the Year.

Congratulations to Heinz Schwarze-Blanke for fighting corruption with “Money Laundering” Supervisory Board. On a website dedicated in part to the definition and exploration of corruption, Heinz Schwarze-Blanke’s subtle, portrayal of corruption’s insidious role in society highlights the problem with a cruel grace.

WEF: Pre-Meeting Press Conference

Welcome to Davos 2018

Welcome to this year’s Davos live blog. We’ll be bringing you highlights from the key sessions, commentary from around the globe, and some of the bits you might have missed. The live blog team will guide you through the meeting, from today, all the way through to the finish on Friday.

The doors might not yet be open officially, but here’s what you need to know before we get going.

Why 2018 must be the year for women to thrive

Leaders from around the world are meeting in Davos at a time of global economic recovery, a time when governments must do all they can to sustain this momentum and lay the foundations for long-term growth. Helping women make the most of their potential is a key part of this equation.

Time is up for discrimination and abuse against women. The time has come for women to thrive.

@wef

Tax-Avoidance Schemes Are Being Offered Up To The Wealthy Like Vacation Packages

Giant Leak of Offshore Financial Records Exposes Global Array of Crime and Corruption

Millions of documents show heads of state, criminals and celebrities using secret hideaways in tax havens…ICIJ

Tax-avoidance schemes are being offered up to the wealthy like vacation packages

Rosie Perper, Business Insider reports: Tax-avoidance schemes, that include creating offshore accounts in tax-free countries, are being offered to the wealthy like vacation packages. A screenshot of the TMS Group’s “International Business Company Packages” page shows several plans — called “The Indian Ocean,” “The Caribbean,” and “The Oasis” — being offered to businesses or individuals shopping around for the best place to open up an offshore account.

Two of the packages promote setting up a company in one country, then creating a business address and offshore bank account in two more countries. Seychelles and Belize are offered as possible locations for the company set-up, while Malaysia is the chosen country for business addresses.

Another site, Offshore Desk, offers an €1890 ($2,300 USD) “Seychelles Package,” allowing taxpayers of any country to incorporate a business in Seychelles and a bank account in Cyprus. Similar packages for offshore accounts in Vanuatu and Delaware, are shown on the site accompanied by flashy photos and low-cost promises.

Information obtained from the leaked Panama Papers showed offshore accounts were, in some cases, used to avoid taxes, conceal transactions, and launder money.