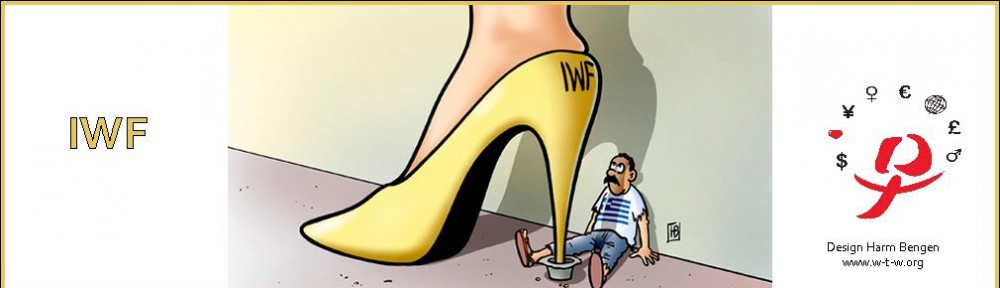

Greek Prime Minister Tsipras writes in Le Monde (translation by w-t-w.org): The Greek people made a courageous decision. They dared to challenge the one-way street from the rigorous austerity of the Memorandum, in order to claim a new agreement. The Greek people paid a high price for these mistakes. In five years, unemployment has soared to 28% (60% for young people), and average income fell by 40%, while Greece, according to Eurostat statistics, has become the State of the Union European (EU) having the highest social inequality index.

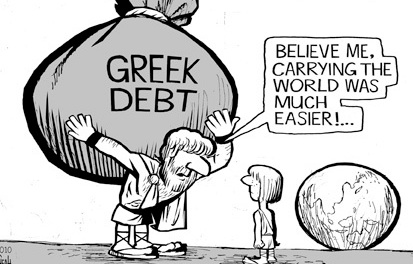

Worse, despite the blows that have been brought to the social fabric, the program failed to restore the Greek economy’s competitiveness. Public debt has soared by 124% to 180% of GDP. The Greek economy, despite the great sacrifices of his people, is still trapped in a climate of uncertainty caused by ongoing non attainable goals of the doctrine of the financial equilibrium, which obligate to stay in a vicious circle of austerity and recession.

The main aim of the Greek government in the last four months is to end this vicious circle and to this uncertainty. A mutually beneficial agreement that will set realistic targets in relation to surplus while reintroducing the development agenda and investment – a definitive solution to the Greek case – is now more necessary than ever. Moreover, such an agreement will mark the end of European economic crisis that erupted there seven years, ending the cycle of uncertainty for the euro area.

Today, Europe is able to take decisions that will trigger a strong recovery of the Greek and European economy by ending scenarios of a “Grexit” (Greek exit). These scenarios prevent the long-term stabilization of the European economy and are likely to undermine confidence at any time both citizens and investors in our common currency.

However, some argue that the Greek side does nothing to move in this direction because it comes to negotiations with intransigence and without proposals. Is that the case?

Tsipras continues in this vein and ends with the caution from John Donne as quoted by Ernest Heminway: For whom the bell tolls, but does not get to: “If a clod be washed away by the sea, Europe is the less.”