As expected, the tournament will still take place in Russia in 2018 and Qatar in 2022, after the 18-month investigation found insufficient evidence of corruption.

Garcia, a former U.,S. attorney, immediately fired back, accusing Eckert of whitewashing his original 430-page report and reporting him to FIFA’s appeals committee. “Today’s decision by the Chairman of the Adjudicatory Chamber contains numerous materially incomplete and erroneous representations of the facts and conclusions detailed in the Investigatory Chamber’s report,” Garcia said.

There’s lots to take issue with here, from the lack of cooperation from several Qatari officials, to Russia’s claim that destroying all records of the bidding process was standard operating procedure and not a cover-up. But the biggest problem remains the complete lack of independent oversight of one of the largest governing bodies in sports, tasked with investigating itself while having little motivation for transparency or the truth.

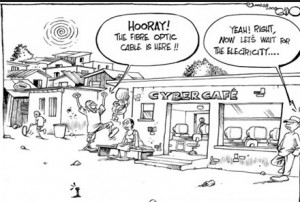

FIFA is also too big for its own good. Dozens of corruption scandals in the past decade have done little to ebb the endless profits that come from running the most popular sport in the world. FIFA made $2 billion in profit from this year’s World Cup in Brazil. And this in spite of endless protests by the local poor who would see not one cent of that money, and the “slave-like” conditions faced by the migrant workers who built the stadiums.

It will only get worse come 2022. In March, the International Trade Union Confederation estimated that 1,200 migrant workers had already died in Qatar. That number is expected to rise to 4,000 by the time the World Cup comes to Doha. Qatar has pledged numerous times to fix its problem with worker exploitation, most recently in an unenlightening interview with the Associated Press earlier this week. But report by Amnesty International released Wednesday demonstrated heavy foot-dragging by the Qatari government, stating that while some reforms have been proposed, most of them have yet to be implemented and offer solutions that are ancillary at best. “Time is running out fast,” the report states. “The legacy of the FIFA 2022 World Cup would be the hundreds of thousands of workers who were exploited to make it happen.”

While boycotts seem unlikely, foreign governments are remaining watchful of FIFA’s affairs. Unsatisfied with the ethics committee’s decision, the FBI will continue its own three-year investigation of FIFA. Meanwhile, a British MP has asked the UK’s Serious Fraud Office to look into the matter as well.

Supporters of Russia and Qatar will no doubt cry foul, accusing these governments of bias and sour grapes for losing their own bids.