Navi Radjou and Jaideep Prabhu write: In a famous 1937 essay, the economist Ronald Coase argued that the reason Western economies are organized like a pyramid, with a few large producers at the top and millions of passive consumers below, is the existence of transaction costs – the intangible costs associated with search, bargaining, decision-making, and enforcement. But with the Internet, mobile technologies, and social media all but eliminating such costs in many sectors, this economic structure is bound to change.

Indeed, in the United States and across Europe, vertically integrated value chains controlled by large companies are already being challenged by new consumer-orchestrated value ecosystems, which allow consumers to design, build, market, distribute, and trade goods and services among themselves, eliminating the need for intermediaries. This bottom-up approach to value creation is enabled by the horizontal (or peer-to-peer) networks and do-it-yourself (DIY) platforms that form the foundation of the “frugal” economy.

Two key factors are fueling the frugal economy’s growth: a protracted financial crisis, which has weakened the purchasing power of middle-class consumers in the West, and these consumers’ increasing sense of environmental responsibility. Eager to save money and minimize their ecological impact, Western consumers are increasingly eschewing individual ownership in favor of shared access to products and services.

As it stands, nearly 50% of Europeans believe that, within a decade, cars will be consumed as a “shared” good, instead of privately owned, and 73% predict the rapid growth of car-sharing services. BlaBlaCar, Europe’s leading car-sharing service, now transports more passengers monthly than Eurostar, the high-speed rail service connecting London with Paris and Brussels. And the better-known service Uber is causing panic among taxi companies worldwide. Despite recent controversy, the company, founded in 2009, is valued at more than $40 billion.

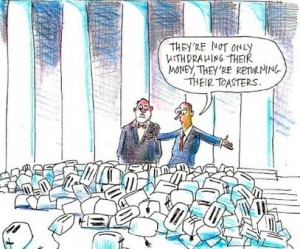

This shift in consumer attitudes extends far beyond transport. The peer-to-peer home-sharing service Airbnb now rents more room-nights annually than the entire Hilton hotel chain. And the peer-to-peer lending market, which bypasses banks and their hefty hidden fees, surpassed the $1 billion mark in early 2012.

The global market for shared products and services is expected to grow dramatically, from $15 billion today to $335 billion by 2025, without requiring any major investment.

The nature of horizontal networks supports this prediction. Such networks begin working long before they reduce transaction costs. By enabling ordinary people to do at home what, a decade ago, only scientists in large labs could do, the Internet economy is lowering the costs of research and development, design, and production of new goods and services in many sectors.

The transition to a frugal economy is happening. Traditional companies must get on board – or risk becoming obsolete.