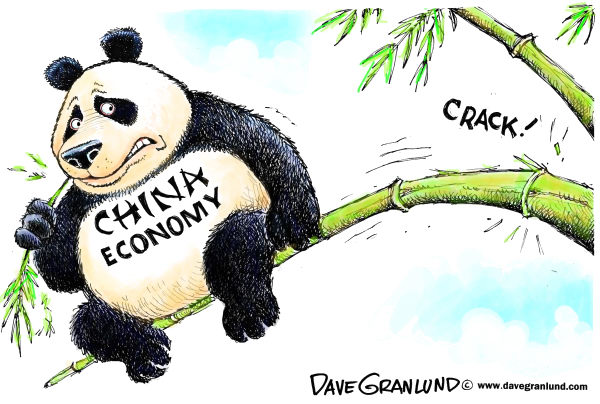

CHina is not implementing long-term solutions. The country’s extraordinary economic difficulties will result in a collapse or a long-term decline, and either outcome suggests China will return to the ranks of weak states if they don’t face facts.

Gordon G. Chang writes: As an initial matter, China’s current situation is far worse than the official National Bureau of Statistics reports. The NBS maintains that the country’s gross domestic product rose 6.9 percent during the third calendar quarter of this year after increases of 7.0 percent during each of the first two quarters.

Willem Buiter, Citigroup’s chief economist, suggests the rate was closer to 4 percent, and growth could be as low as the 2.2 percent that people in Beijing were privately talking about mid-year. The most reliable indicator of Chinese economic activity remains the consumption of electricity, and for the first eleven months of the year electricity consumption increased by only 0.7 percent according to China’s National Energy Administration.

Other statistics confirm extremely slow growth. For instance, imports, a sign of both manufacturing and consumption trends, fell 8.7 percent in November in dollar terms, marking a record thirteen straight months of decline. Exports were down 6.8 percent, the fifth straight month in the red.

Especially disturbing is price data. In Q3, nominal GDP growth of 6.2 percent was less than the officially reported real growth of 6.9 percent. China, therefore, looks like it is now caught in the deflationary trap of falling prices. Deflation, in turn, suggests a 1930s-style crash is increasingly possible. China has too much debt—perhaps as much as 350 percent of GDP at the moment—which becomes impossible to service in an era of rapidly declining prices. The country over the last year has seen a number of “first” defaults. So far, the central and provincial authorities have managed rescues for many of the obligors, but at some point they will have no choice but to let failing borrowers go under in far greater numbers.

In these circumstances, the best case scenario for China is several decades of recession or recession-like stagnation, much like Japan experienced in the 1990s and the first decade of this century. China’s leaders won’t say the goal of the just-completed Work Conference was to avoid the sudden adjustment of a collapse, but that appears to be the case.

To their credit, however, Beijing has been more candid. Chinese technocrats see consumption saving the economy, but that’s unlikely to be the case. Consumer demand is not high, despite what unnamed officials told the media at the conclusion of the Work Conference. Indicators, such as the corporate earnings of retailers and consumer products companies, paint a picture of spending in China growing at an anemic pace.

At the same time, manufacturing, the heart of the economy for decades, looks like it is contracting quickly, and services growth, despite official numbers, is low. Both these developments have implications for consumption. In China, consumption has been the result of growth, not the cause of it, and it is unlikely spending can power the economy on its own for long. What’s Up with the Chinese Economy