A new working paper finds that male financial advisers are considerably more likely to recover after they commit misconduct.

Whet Moser reports: When it comes to sexism in powerful and competitive industries like tech and finance, research tends to start with representation: how many women are employed at different levels of the companies? How many are on corporate boards?

If the number’s not representative of the general population, though, the problem can be difficult to diagnose. Is the problem in the industry itself? Does it go back farther into the talent pipeline, to graduate school, undergraduate, or even K-12, where young women or girls are gradually dissuaded from picking up the skills they need?

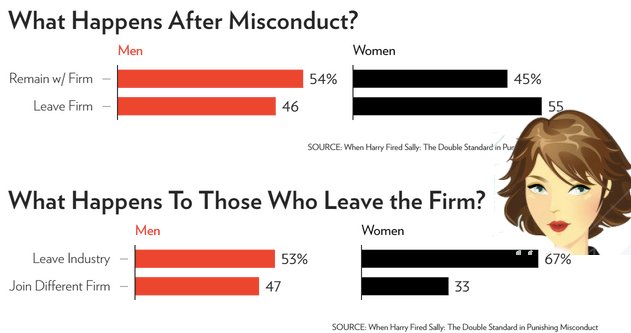

A new working paper, When Harry Fired Sally- The Double Standard in Punishing Misconduct from three professors of finance including the University of Chicago’s Gregor Matvos, takes a clever approach to measuring the presence of gender discrimination in finance: what happens to financial advisers after they commit misconduct? The pipeline question is eliminated; the group under examination is already in the industry…

Why would men be more likely to receive second chances, even though they’re statistically more risky as a gender and not significantly more productive? The authors don’t speculate on mechanisms, but finance professor Lily Fang spent five years looking into gender issues in the stock-research field, and found that, perhaps unsurprisingly, “the networking and personal connections that male analysts rely on so heavily to get ahead are much less useful for women in similar jobs.” It’s who you know: and, possibly, it’s not just about getting ahead, but also not falling off the map. Are Women Punished Harder By the Financial Industry