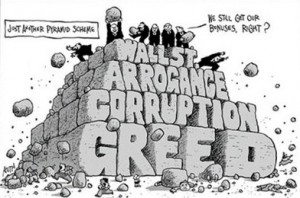

Matt Levine brikskly sums it up:

Rough day for Royal Bank of Scotland. RBS last posted net income back when just about anyone could post net income; since then, counting today’s 3.5 billion pound ($5.4 billion) net loss for 2014, the total losses come to just under 50 billion pounds. That’s more than 9,000 pounds for every man, woman and child in Scotland. It’s more than Bank of America has paid in mortgage settlements. At some point, if you were RBS’s managers or its owners (mostly the U.K. government), wouldn’t you start thinking it might not be worth it to keep going?

A very bank-y thing about RBS is that, after seven years of multi-billion-pound losses, management’s focus is on share repurchases: “By the time we get to 2016, we hope to have satisfied the preconditions we think are needed in order to start a discussion” with regulators about dividends or share repurchases, says the chief financial officer. I feel like the regular-company model is, if you make a lot of money, you give it back to shareholders; if not, not so much. The RBS model is more like: We are losing so much of your money, you shouldn’t trust us with it, here, you take it back. Capital requirements make this difficult, but if RBS can shrink its assets faster than it loses money, it stands a chance.

And for Standard Chartered. StanChart’s board rather surprisingly parted ways with its chief executive officer, Peter Sands, and replaced him with former JPMorgan banker

The chairman is also leaving. “With the share price having about halved since its March 2013 peak, the stock market was looking for a fresh start.

And for HSBC. HSBC executives did not enjoy testifying before Parliament about all the tax-dodging that HSBC facilitated, tCEO Stuart Gulliver’s use of a Swiss bank account held by Panamanian shell company to receive his bonuses, which Gulliver has patiently and repeatedly explained was just to keep his co-workers from seeing how much he made, and not to dodge taxes.

And for Morgan Stanley.

Morgan Stanley agreed to pay $2.6 billion to settle Justice Department mortgage-fraud claims,and also “increased legal reserves for this settlement and other legacy residential mortgage-backed securities matters by approximately $2.8 billion” for 2014.