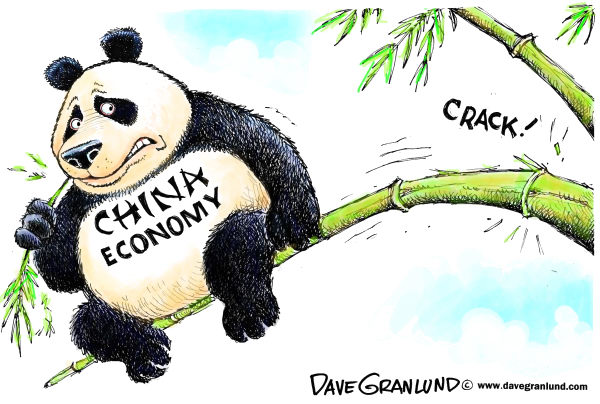

Michael Spence writes: Uncertainty about China’s economic prospects is roiling global markets – not least because so many questions are so difficult to answer. IIn the real economy, the export-driven tradable sector is contracting, owing to weak foreign demand. Faced with slow growth in Europe and Japan, moderate growth in the United States, and serious challenges in developing countries (with the exception of India), the Chinese trade engine has lost much of its steam.

At the same time, however, rising domestic demand has kept China’s growth rate relatively high – a feat that has been achieved without a substantial increase in household indebtedness. As private consumption has expanded, services have proliferated, generating employment for many. This is clear evidence of a healthy economic rebalancing.

The situation in the corporate sector is mixed. On one hand, highly innovative and dynamic private firms are driving growth. On the other hand, the corporate sector remains subject to serious vulnerabilities. The rapid expansion of credit in 2009 led to huge over-investment and excess capacity in commodity sectors, basic industries like steel, and especially real estate.

Despite these challenges, the reality is that China’s transition to a more innovative, consumer-driven economy is well underway. This suggests that the economy is experiencing a bumpy deceleration, not a meltdown.

As it stands, non-performing loans are on the rise, owing largely to the weaknesses in heavy industry and real estate.

China may need to rely on the large state balance sheet for loan consolidation, debt write-offs, and bank recapitalization.

Net private capital outflows remain substantial, and show no signs of slowing. As a result, the reserves held by the People’s Bank of China (PBOC) have declined by roughly $500 billion over the last year, with particularly large declines of some $100 billion in each of the last two months.

President Xi Jinping’s intensive anti-corruption campaign and, more generally, declining official tolerance for heterodox views also impact the economy. Those who feel directly threatened by the anti-graft campaign might be inclined to take their money out of China.

Given China’s systemic importance in the global economy, uncertainty about its plans and prospects is bound to send tremors through global capital markets. That is why it is so important that the Chinese government increase the transparency of its decision-making, including by communicating its policy decisions more effectively.

The principal unaddressed problem affecting China’s financial system is the pervasiveness of state control and ownership, and the implicit guarantees that pervade asset markets. This leads to misallocation of capital (with small and medium-size private enterprises struggling the most) and the mispricing of risk, while contributing to a lax credit culture. The absence of credit discipline is particularly problematic when combined with highly accommodative monetary policy, because it can artificially keep zombie companies afloat.

To resolve this problem, China’s leaders must segregate the state balance sheet from the credit allocation system.

China’s current bout of economic volatility is likely to persist, though increased transparency could do much to blunt it. Add to that the smart use of state resources, together with sure-footed reforms, and China should be able to achieve moderate yet sustainable long-term growth.