Should we look at who drives stock prices up as well as who helps them go down?

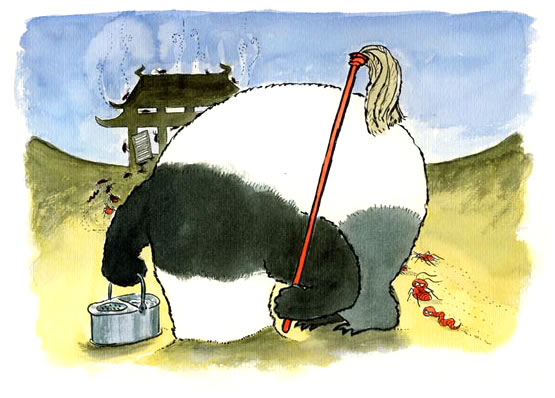

Matt Levine writes about Chinese markets: When Chinese stock markets were crashing earlier this year, authorities were quick to blame short sellers and market manipulation. It’s reasonable to be skeptical. Sometimes markets go down because they are overvalued, not because a cabal of evil hedge fund managers is manipulating them.

Chinese authorities have detained the leading light of the “Limit-up Kamikaze Squad”, a group of hedge fund managers known for their fearless speculation.

Xu Xiang, general manager of Zexi Investment Management, was apprehended on Sunday on suspicion of insider trading after a police manhunt.

He was “captain” of the loose collection of fund managers centred around the coastal city of Ningbo in eastern Zhejiang province who are known for pushing favoured stocks up by the 10 per cent daily limit on Chinese exchanges.

A frequent criticism of these sorts of crackdowns is that authorities are quick to blame manipulative short sellers when stocks go down, but are less concerned about manipulation on the way up. Pushing stocks up is just as manipulative as pushing them down. But in fact, while it’s not clear what exactly the charges against Xu are, they might well be related to upward manipulation.

Mr. Xu’s Zexi Investment, based in Shanghai, was the subject of intense market speculation in September, when a post on social media accused the company of market manipulation. The online post suggested that Zexi had told China’s biggest brokerage, Citic Securities, to buy shares of an unprofitable Shanghai clothing retailer to lift its price for one of its politically connected investors. At the time, Zexi said the attacks were “fabrications from nowhere and malicious attacks.”