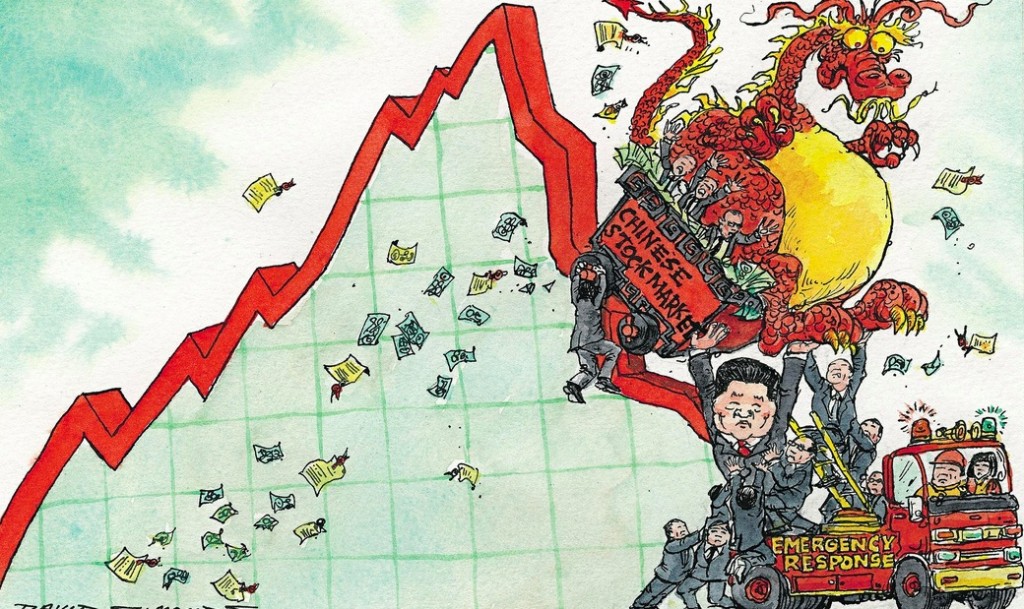

Managers of Harvard’s endowment are looking for help in preparing for the market’s downside.

Lucinda Shen writes: America’s largest university endowment wants more money managers who will bet on a stock falling.

The chief executive of Harvard Management Company, which manages the university’s $37.6 billion endowment, on Tuesday warned about “potentially frothy markets.”

Stephen Blythe added that the endowment is now looking for stock managers that will short stocks as well as go long.

“We have renewed focus on identifying public equity managers with demonstrable investment expertise on both the long and short sides of the market,” he said.

In an annual letter to investors, Blyth wrote that the market “presents various challenges to investors” and that it is time to proceed “with caution in several areas of the portfolio.”

The endowment returned 5.8% through June 30, though the performance of the absolute return portfolio was underwhelming. The $6 billionportfolio returned 0.1% in fiscal year 2015. That compares to a benchmark of 3.5%, according to the report.

Blyth said the endowment was seeking to decrease exposure to equities and inflation and increase exposure to the dollar, bonds, and the high yield market.