Sophisticated tech support now available for registered investment advisors allows them to strike out on their own.

A group of Bank of America Corp. private bankers that helped anchor the firm’s wealth-management practice in one of California’s wealthiest enclaves has defected to start an independent company.

The seven advisers managed about $3.3 billion in client assets out of Newport Beach.

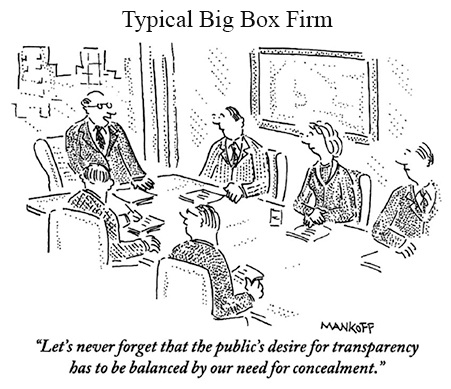

The group is joining a stream of advisers and private bankers leaving big banks and brokerages to start their own boutiques, hoping to exert more control over their dealings and keep a greater share of the revenue. They’re making use of technology ventures that provide record-keeping, custody services and product offerings once available only at the largest firms.

The new tech ventures that aid the boutiques are a growing nuisance for banks and brokerages, which have long focused on wresting each others’ talent.

While it’s difficult to find figures that rank the size of teams leaving the largest brokerages to form their own ventures, the Corient group counts as “a very large practice” with an average of about $470 million in client assets managed by each person.

As independents, the group will be freer to go after new customers. Bank of America advisers often compete with other employees such as those at its U.S. Trust and advisory units in trying to attract or service the same clients, Henderson said.

Four of Corient’s seven advisers attended Brigham Young University in Provo, Utah, and met after college, Henderson said. Bel Air’s Halladay also is an alumnus of the Mormon church-affiliated institution.

The group bolted with help from Dynasty Financial Partners, a firm founded by formerCitigroup Inc. executives that finds office space, sets up trading systems and handles such details as printing business cards and marketing materials. Chicago-based HighTower Advisors LLC, Focus Financial Partners LLC in New York and Tru Independence LLC in Portland, Oregon, also are in the business.

Corient is among the biggest teams that Dynasty has helped turn into independent investment advisers over its five-year history, according to Shirl Penney, Dynasty’s founder. In June, the firm helped a group managing $3 billion at Deutsche Bank AG to break away and form their own firm.

The 20,000 independent RIAs in the U.S. have gained market share every year since 2007, more than doubling their assets to $2.7 trillion as of 2014, according to Aite Group. Client assets at the largest retail brokerages of UBS Group AG, Morgan Stanley, Wells Fargo & Co. and Bank of America rose 14 percent to $6.6 trillion in the same period, Aite said.