The Rocky Road to Globalization

John Kehoe writes: As US President Barack Obama calibrated his golf swing on vacation this week and Federal Reserve chairwoman Janet Yellen readied her trigger finger to raise interest rates, China’s currency depreciation was a shock neither leader was likely prepared for.

Politically and economically, the yuan devaluation is being felt in the United States.

For Obama, the cheaper Chinese currency has given new ammunition to American critics of the state-controlled rival economy.

Obama is due to host Chinese President Xi Jinping at the White House next month, so the rev-up of anti-Chinese sentiment from Republicans and Democrats creates a potentially awkward backdrop for the important bilateral relationship.

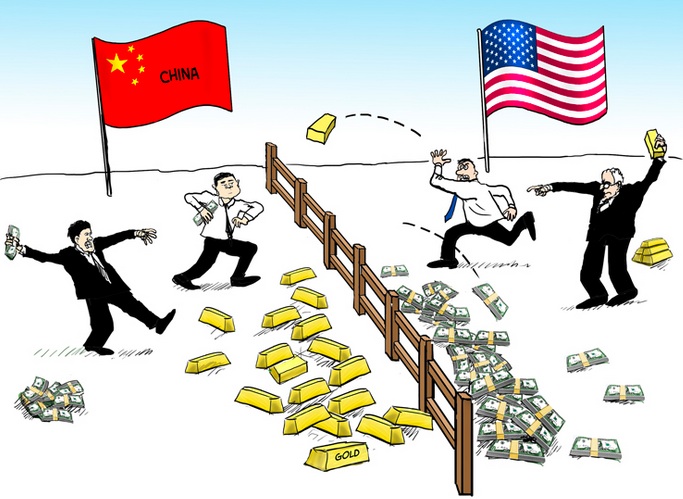

The US posted a record $US343 billion trade deficit with China last year. The yuan depreciation will cheapen Chinese imports and make US exports to China more expensive, exacerbating the gap.

US manufacturers blame Obama’s engagement of China for the “currency manipulation” designed to “flood the world with cheap China imports and put US manufacturers out of business”.

Scott Paul, president of the Alliance for American Manufacturing, is pressing Congress to insert currency provisions into the Trans-Pacific Partnership trade accord.

Still, the US Treasury and the International Monetary Fund have presented a more nuanced response to China ostensibly shifting towards a more market-determined exchange rate. The Washington-based IMF was supportive and the US Treasury, which has long pressed China to adopt a market-based currency, offered faint praise.

Yet the domestic political heat on Obama will not relent, as politicians ramp up their rhetoric on the evils of Beijing in a populist pitch to voters.

A few blocks away from the White House, Yellen will be weighing the unexpected Chinese currency lowering. The Fed has been inching towards its first rate hike in nine years, which many expect as soon as September.

The yuan devaluation – and, by definition, appreciation of the US dollar – will tighten financial conditions in the US, at least at the margin. As well as worsening the trade balance, the stronger greenback against the yuan cuts the dollar earnings of US multinationals operating in China.

Investors were already skittish about companies with big exposures to China, such as Apple and Procter & Gamble, as the world’s second-biggest economy slowed in recent months.

The Fed is itching to raise rates from about zero, where they have stooped for more than six years.

The US jobless rate of 5.3 per cent has the Fed comfortable enough that the labour market is ready for a gentle rise in borrowing costs. But persistently weak inflation may be reason to hold off pulling the trigger.

If the yuan continues to fall sharply, the spectre of global deflation becomes a bigger threat. Cheapened Chinese exports could flood the world market as Beijing keeps its labour-intensive factories pumping, at a time when plunging commodity values are already pushing down world prices.

The risk is that other countries might follow China and devalue via monetary policy easing and currency interventions, unleashing a broader currency war.

Much will depend on Chinese actions from here. If the devaluation is halted in an orderly fashion at about 5 per cent, the overall impact is likely to be minimal.

But if the devaluation accelerates or the Chinese authorities lose financial control, Yellen and Obama will be in a real bind.