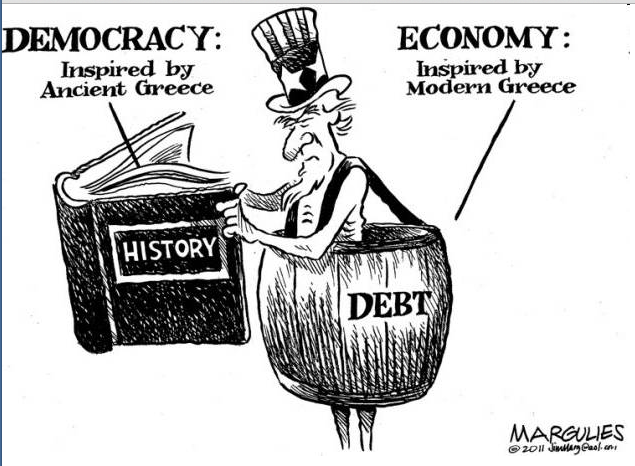

Alexander Friedman writes: In his Pulitzer-Prize-winning book, Lords of Finance, the economist Liaquat Ahamad tells the story of how four central bankers, driven by staunch adherence to the gold standard, “broke the world” and triggered the Great Depression. Today’s central bankers largely share a new conventional wisdom – about the benefits of loose monetary policy. Are monetary policymakers poised to break the world again?

Orthodox monetary policy no longer enshrines the gold standard, which caused the central bankers of the 1920s to mismanage interest rates, triggering a global economic meltdown that ultimately set the stage for World War II. But the unprecedented period of coordinated loose monetary policy since the beginning of the financial crisis in 2008 could be just as problematic. Indeed, the discernible effect on financial markets has already been huge. Banking Dominates FInancial Policy?