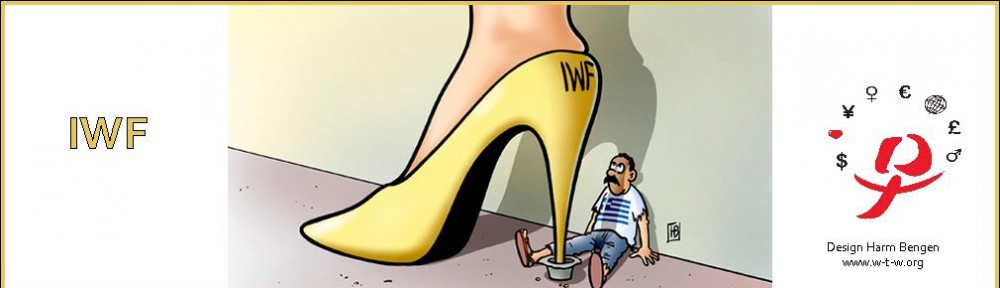

The Econmist editorializes: European Union has never seen the like of the past eight days in Greece: barred banks, capital controls, the first IMF default by a developed country, the collapse of a multi-billion-euro bail-out, plans for a referendum that may hasten Greece’s ejection from the single currency, and the beggary of the people. Were the stakes not so high, all those emergency summits and last-minute demands would count as farce.

Instead it is a tragedy, where an outcome that all sides say they do not want—Greece’s exit from the euro—seems increasingly likely. The chaos is evidence that leaving the euro would be disastrous for Greece, not least because modest gains from default and devaluation would be overwhelmed by political and economic instability. For the rest of Europe, too, “Grexit” has well-rehearsed risks, notably that of a failing state on the continent’s south-eastern flank. But as the drama has become more desperate, so Europeans seem less worried. They take comfort from the fact that Greece is uniquely dysfunctional. Game-playing and repeated miscalculation have poisoned the negotiations (see article). Without Greece, many now conclude, the euro zone might actually be more stable. Facing up to the Euros Contradictions