Jim O’Neill writes: In a forthcoming paper, the Review on Antimicrobial Resistance estimates that bringing new antimicrobials to market and improving their administration will cost about $25 billion – a significant sum, but one that pales in comparison to the costs to society if the problem is not checked.

While the review has yet to come up with recommendations for financing the development of new drugs, it seems clear that it is well within the capacity of the pharmaceutical industry to contribute. A common argument made by drug companies is that they need to be guaranteed a reward if they are to invest in developing medicines that are unlikely to deliver the kind of returns that other investments may provide.

Why should the pharmaceutical industry play a major role in financing something like a common “Innovation Fund” to provide financing for early-stage research into solving the problem of antimicrobial resistance?

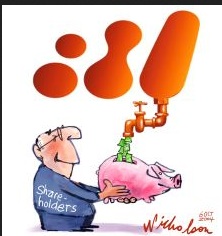

Share buybacks do not seem justified – especially when considered from the standpoint of enlightened self-interest. In December, the pharmaceutical giant Merck spent $8.4 billion to acquire Cubist Pharmaceuticals, a Massachusetts-based drug-maker that specializes in combating Methicillin-resistant Staphylococcus aureus (MRSA), a bacteria that has become resistant to many types of antibiotics.

In early March – less than three months after the acquisition – Merck announced it would close down Cubist’s early-stage research unit. Three weeks later, Merck announced that it would spend an additional $10 billion to buy back some of its shares.

Of course, dubious buybacks are not confined to the pharmaceutical industry. Apple is another good example. Within a year, China will likely be a bigger market for Apple’s products than the United States.

In April, the company announced it had authorized an additional $50 billion to be used for repurchasing shares, bringing the total to $140 billion.

Coming at a time when the technology industry is under increasing scrutiny in the developed world as governments struggle with budget shortfalls and rising debt, this seems to me to be a questionable decision. Companies’ ability to minimize their global tax burden, while boosting their earnings per share through buybacks – in some cases financed with debt – does not strike me as a stable trend.

When companies are genuinely unable to identify areas of research and investment that would help their business (and employees and clients), they are better off returning the savings to shareholders in the form of higher dividends than authorizing buybacks.