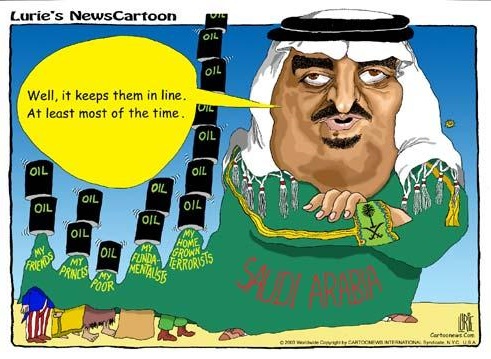

Anjli Raval in Riyadh writes: Saudi Arabia says its strategy of squeezing high-cost rivals such as US shale producers is succeeding, as the world’s largest crude exporter seeks to reassert itself as the dominant force in the global oil market.

The International Energy Agency has released data backing up the Saudi position. The agency said that with the number of rigs running in the US plunging by 60 per cent in response to lower oil prices, US shale oil production had “buckled” in April, “bringing a multiyear winning streak to an apparent close”.

But the IEA also cautioned that it would be “premature” to suggest that Opec had “won the battle for market share”. It said global crude supply was growing, even from high-cost areas such as Brazil, as well as from other Opec member states such as Iran and Iraq.

However, the Saudi official said he expected the kingdom to maintain its dominance of global energy, despite the growth of alternatives to fossil fuels and competition from rival oil producers within Opec and beyond. “Saudi Arabia wants to extend the age of oil,” he said. “We want oil to continue to be used as a major source of energy and we want to be the major producer of that energy.”

Saudi officials explained that the policy was designed to put pressure on producers that require a higher oil price to be economic such as US shale drillers and companies operating in Brazil’s offshore fields. These they believed would be the first to collapse in a survival of the fittest as prices plunged.

Expectations are already rising that the market could start to tighten.

US shale producers would also disagree that Saudi Arabia has succeeded in squeezing them. The US oil industry has slowed down.

The Saudi official admitted “increased efficiencies” were likely as US shale and other producers adjusted to lower prices. He also said the impact of the price rebound was still “unknown” and “there is not yet any clarity on the US supply curve and drivers”.