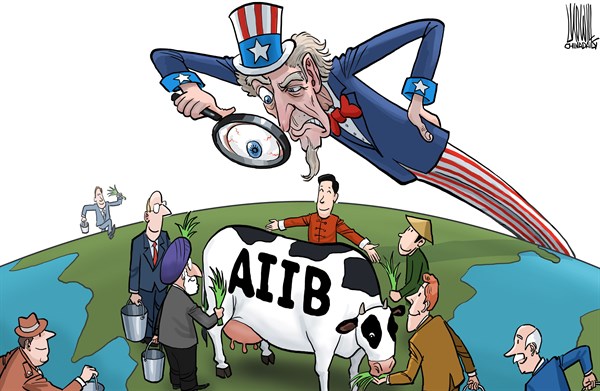

Andrew Sheng writes: Despite official American and Japanese opposition, 57 countries have opted to be among the founding members of the China-led Asian Infrastructure Investment Bank (AIIB). Regardless of what naysayers believe, this remarkable turn of events can only benefit global economic governance.

According to former US Treasury Secretary Larry Summers, the AIIB’s establishment “may be remembered as the moment the United States lost its role as the underwriter of the global economic system.”

Who is right will depend largely on the decisions that the AIIB’s top shareholders make regarding its operating structure. So far, the AIIB has not sought to amend the principle that the largest contributor to a multilateral organization gets the largest say in running it.

This implies a larger global leadership role for China. Massive debts have lately undermined the ability of the US – not to mention Europe and Japan – to continue making such large contributions to hte IMF. Fortunately, China is willing and able to fill the gap.

China has a 3.8% voting share in the IMF and World Bank, even though it accounts for more than 12% of world GDP.

The AIIB has its own objectives, which do not align precisely with those of, say, the World Bank. Specifically, the bank is a critical element of China’s “one belt, one road” strategy, which encompasses two initiatives: the overland Silk Road Economic Belt, connecting China to Europe, and the 21st Century Maritime Silk Road, linking China to Southeast Asia, the Middle East, and Europe.

Connectivity is vital to economic growth. Over the last three decades, the construction of roads, railways, ports, airports, and telecommunications systems in China has fostered trade, attracted investment, and, by linking the country’s land-locked western and southern provinces to its more prosperous coastal areas, helped to reduce regional disparities.

China’s Silk Road initiative, which aims to boost prosperity among China’s trading partners largely through infrastructure investment, is a logical next step – one on which China is spending significantly.t.

Given massive global demand for infrastructure finance – which, according to ADB estimates, will amount to $8 trillion in Asia alone over the next decade – the AIIB should not be considered a threat to the World Bank, the ADB, or other multilateral lenders.

The AIIB’s operations will most likely resemble those of the World Bank in the 1960s, when engineers with hands-on development experience dominated the staff and could design lending conditions that worked for borrowers.

The acid test of the AIIB’s effectiveness will be its governance model. One failing of the Bretton Wood institutions is their full-time shareholder boards of directors, which tend to undermine effectiveness by micro-managing and often requesting conflicting lending conditions.

Even if the AIIB does not deliver as promised, its establishment is an important reminder that in a fast-changing world, economic governance cannot remain stagnant. If Western leaders really do believe in innovation, competition, and meritocracy, they should welcome the AIIB.