Everett Rosenfeld writes: A UK trader is charged for manipulation contributing to 2010 flash crash.

A high-frequency futures trader has been charged with illegally manipulating the stock market, contributing to the May 2010 “flash crash,” according to documents unsealed Tuesday.

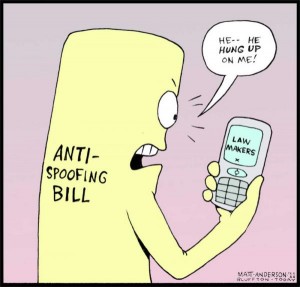

The US Justice Department charged the United Kingdom’s Navinder Singh Sarao with wire fraud, 10 counts of commodities fraud, 10 counts of commodities manipulation and one count of spoofing (which is when a trader places a bid or offer with the intent to cancel before execution).

Sarao was arrested Tuesday in the U.K., and the U.S. is requesting his extradition, the DOJ said. The charges were filed in a federal complaint in February, but were unsealed Tuesday following the arrest.

The Commodity Futures Trading Commission also filed parallel civil charges against Sarao on Tuesday, calling him a “very significant player in the market.”

The CFTC alleged that Sarao was believed to have profited by about $40 million for his scheme. U.S. authorities have frozen nearly $7 million worth of his assets and accounts, Aitan Goelman, CFTC director of enforcement.