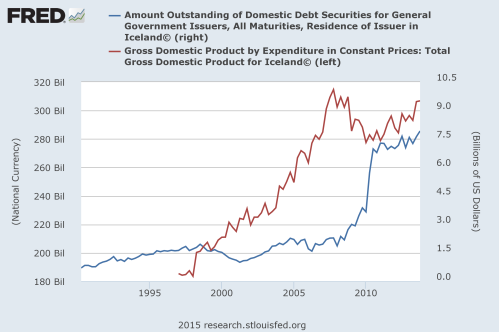

Dirk Ehnts writes; The ongoing economic recovery in Iceland started in 2010. The economic crisis (= recession), as you can see in the chart below, started in about 2007. Only 3 years and a loss of GDP of roughly 10% later, the economy started growing again. Look, however, at the amount outstanding of domestic debt securities for general government issuers. It has risen very fast in the crisis, probably because of falling tax income/

After 2010, the increase in government debt continues, now growing at a lower rate, but nevertheless growing steadily.

Iceland is not the euro zone. It has its own currency, which is part of the success story. The success consists at least to a part on the combination of flexible exchange rate with capital controls, discretionary government spending and no bank bail-out. The Gini coefficient (0 = complete equality of income; 1 = inequality) in 2013 is back where it was in 2003: at .24.

Capital controls are said to go within the next two years:

Most members of Iceland’s parliament say the coalition government led by Premier Sigmundur D. Gunnlaugsson will be able to lift capital controls before its term comes to an end in two years.

Iceland appears to have an exchange rate regime exchange that moves from capital controls and weak currency in bad times to flexible currency only in normal times and then might lead to a flexible exchange rates with exchange rate administration by the central bank in times of frenzy (just guessing here). This is an interesting development.