Seth Mason writes Recently, two prominent Republicans, Banking Chairman Richard Shelby of Alabama and House Financial Services Jeb Hensarling of Texas, stated that they plan to explore proposals that would roll back a long-standing provision that gives the president of the New York Federal Reserve an automatic position as vice chairman of a powerful committee that oversees Wall Street banks.

Not surprisingly, long-time New York Fed President vehemently opposes this.

Many high-ranking Fed officials, including former Chairman Ben Bernanke, current Chairwoman Janet Yellen, and the aforementioned William Dudley, purportedly oppose an audit of the Fed because doing so would undermine the “independence” of our nation’s central bank.

The most powerful Wall Street bankers of the early 20th century pressured the federal government to facilitate the creation of the Federal Reserve under the pretense that a central bank was necessary to ensure bank solvency during panics. Nevertheless, the Fed allowed hundreds of small and medium-sized banks to fail during the Great Recession while protecting its Wall Street brethren. Not only did the Fed selectively bail out the so-called “Too Big to Fail” banks to the tune of $14 trillion, but it allowed them to gobble up assets and competition from the faltering smaller banks and then pumped them more than $4 trillion in liquidity with which to stream into the Wall Street casino! The Fed has made this depression a gilded age on Wall Street.

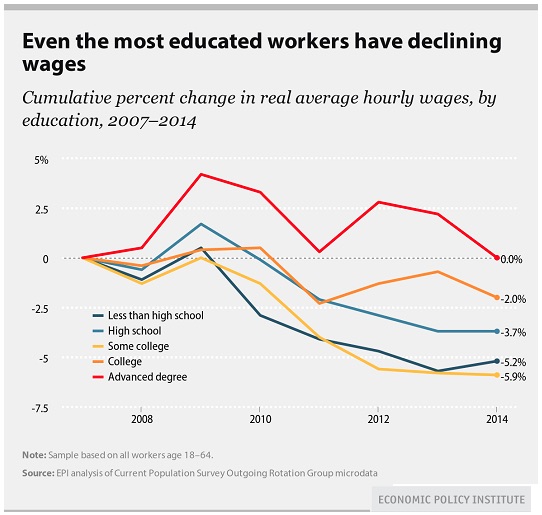

For Main Street, however, the past seven years have been a dark period in American economic history. During a period in which the Fed has facilitated the doubling of the stock market and tremendous bubbles in other assets held in great quantities by the Wall Street elite, ordinary Americans of all education levels have been earning less, millions of them having undergone long periods of unemployment and/or underemployment as a result of the bursting of the Fed’s last asset bubble:

The Fed looks out for its Wall Street buddies at the expense of everyone else. The Fed-Wall Street revolving door must be shut.