Sen. Elizabeth Warren, D-Massachusetts, and Rep. Elijah Cummings, D-Maryland have asked the Federal Reserve Board for a briefing about its investigation into a leak of confidential Fed policy deliberations two years ago.

They sent their request to Scott G. Alvarez, the board’s general counsel, saying that neither Alvarez

“Nor any other Federal Reserve official has made public any information about the conduct of the investigation or its outcome.”

The two wrote:

“We are disturbed by this lack of transparency regarding such an important topic. This leak contained key market-moving information, violated Federal Reserve policy on disclosure, and may have represented a violation of federal law.”

Details from discussions of the Federal Open Market Committee found their way into a financial analyst’s private newsletter. The leak occurred in October 2012, the day before the scheduled public release of committee meeting minutes that promised to shed new light on a third round of bond buying to boost the economy.

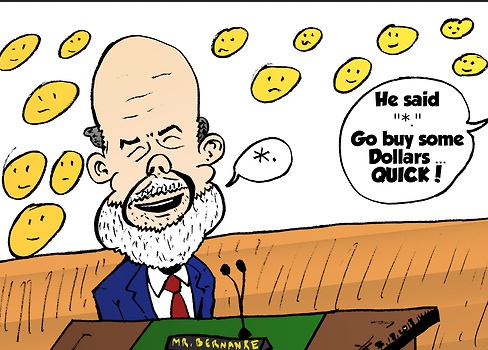

The newsletter revealed what the minutes would say as well as fresh details about the Fed’s internal plans and deliberations – information that could have provided traders with an edge. Then-Fed Chairman Ben Bernanke asked Alvarez and the board’s secretary to look into the matter. The Fed never revealed the investigation and only publicly acknowledged the leak in a response to a freedom of information request by ProPublica.

The Fed confirmed receiving the letter but had no comment beyond saying it would respond.

Warren is the ranking minority member of the Senate Banking Subcommittee on Economic Policy and Cummings is the ranking minority member of the House Committee on Oversight and Government Reform.

The letter asks Alvarez to brief Warren and Cummings’ respective staffs by Feb. 15.

The letter lays out five questions the two would like answered, including whether the inspector general or the FBI was involved in looking into the matter; the status of the investigation; and what the Fed has done to prevent such leaks in the future.