The Greek government wants to overhaul 30% of its bailout obligations, replacing them with a 10-point plan of reforms.

The EU-IMF bailout for the debt-laden country expires on 28 February and Greece does not want it extended.

Instead the new Athens government is asking for a “bridge agreement” that will enable it to stay afloat until it can agree a new four-year reform plan with its EU creditors.

Prime Minister Alexis Tsipras’s government won a confidence vote with the support of 162 deputies in the 300-seat parliament.

The Athens stock exchange then fell by 4% ahead of the emergency Eurogroup meeting, which will see Finance Minister Yanis Varoufakis unveil the controversial debt proposals.

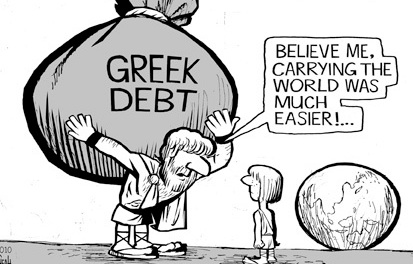

The Syriza-led government says the conditions of the €240bn (£182bn; $272bn) bailout – sweeping spending cuts and public sector job losses – have impoverished Greece.

The government’s proposal for overhauling its bailout is: 1. Greece would co-operate on 70% of its bailout conditions but wants to scrap 30% – replacing it with 10 new reforms to be agreed with the Organisation for Economic Cooperation and Development (OECD). It is unclear what these would be. 2.Bond swaps 3. Reduce the primary budget surplus target for this year to 1.49% of GDP, rather than the 3%.

A swift deal with the EU is considered unlikely. Most finance ministers – including Germany’s Wolfgang Schaeuble – are insisting that Greece must not renege on its bailout conditions.

Speaking ahead of the Eurogroup meeting, its president, Jeroen Dijsselbloem, said he did not expect a deal with Greece on Wednesday but that the group would listen to Greece’s ideas.

Meanwhile the head of the IMF, Christine Lagarde, praised Greek officials as “competent”, but warned that reaching an agreement would take time.

On the eve of the meeting, Finance Minister Yanis Varoufakis did not rule out clashing with his eurozone counterparts, saying: “If you are not willing to even contemplate a rift, then you are not negotiating.”

The stakes of the talks are high because of fears that a Greek debt default could push it out of the euro, triggering turmoil in the EU.

Greece’s debt currently stands at more than €320bn (£237bn) – about 174% of its economic output (GDP).

Last month’s election win by radical left-wing party Syriza has led to suggestions that Greece could forge closer ties with Russia, although Greek officials have downplayed the idea.

After meeting his Greek counterpart Nikolaos Kotzias on Wednesday, Russia’s Foreign Minister Sergei Lavrov said Moscow would consider a request for financial aid from Athens if it came – despite Russia’s own financial difficulties caused by Western sanctions over the crisis in Ukraine.

The Greek Defence Minister, Panos Kammenos, previously said Greece might seek funding from Russia, China or the US if it failed to reach a new debt agreement with the eurozone.