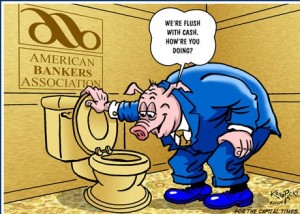

Simon Johnson writes: Citigroup took advantage of the budget approval process in te US Congress to tuck into thousands of pages of law the repeal of some of the 2010 Dodd-Frank financial reforms. The passages were drafted by Citigroup lobbyists and inserted in legislation at the last moment.

At a stroke, Citi executives demonstrated both their continued political clout in Washington and their continued desire to take on excessive amounts of financial risk. This is exactly what Citi did during the 1990s and 2000s under Presidents Bill Clinton and George W. Bush – with catastrophic consequences for the broader economy in 2007-09.

Breaking up Citigroup is under serious consideration as a potential campaign theme. For example, in a powerful speech – watched online more than a half-million times – Senator Elizabeth Warren responded uncompromisingly to the megabanks’ latest display of muscle: “Let’s pass something – anything – that would help break up these giant banks.”

Warren is attracting a great deal of support from the center and the right.

Senator David Vitter of Louisiana is the most prominent Republican member of Congress in favor of limiting the size and power of the biggest banks, but there are others who lean in a similar direction. The vice chair of the Federal Deposit Insurance Corporatio consistently warns about the dangers associated with megabanks. Former FDIC Chair Sheila Bair, a Republican from Kansas, argues strongly for additional measures to rein in the biggest banks.

From the perspective of anyone seeking the nomination of either of America’s political parties, here is an issue that cuts across partisan lines. “Break up Citigroup” is a concrete and powerful idea that would move the financial system in the right direction. It is not a panacea, but the coalition that can break up Citi can also put in place other measures to make the financial system safer.

Megabanks are accused of abuse of power and the great rip-off of the middle class. Crony capitalism is implicit in the massive implicit government subsidies that these banks receive. Both left and right agree on the fundamental asymmetry that the recent “Citigroup Amendment” implies: Bankers get rich whether they win or lose, because the US taxpayer foots the bill when their risky bets fail.

Potential Republican presidential candidates have hesitated to take up this issue in public – perhaps feeling that it will inhibit their ability to raise money from Wall Street. Among the Democrats, however, the opportunity seems to be much more compelling; indeed, avoiding a confrontation with Wall Street might actually create problems for a candidate like Hillary Clinton who is close to Wall Street.

This idea would attract support from centrists. “Break up Citigroup, end dangerous government subsidies, and bring back the market.” The US presidential candidate who says this in 2016 – and says it most convincingly – has a good chance of winning it all.