Giles Merritt writes: The new European Commission President Jean-Claude Juncker had barely moved into his new office when journalists around the world started seeking answers regarding the Luxembourg’s government under Juncke’s tax-avoidance deals with multinational corporations at the expense of ordinary taxpayers.

Indeed, though Juncker admitted to being “politically responsible” for the controversial tax rulings, owing to his position as finance minister and prime minister when they were signed, he stressed that Luxembourg had always been in compliance with national legislation and international rules.

Juncker then took his case to the European Parliament, many of whose members had been openly critical of the tax deals.

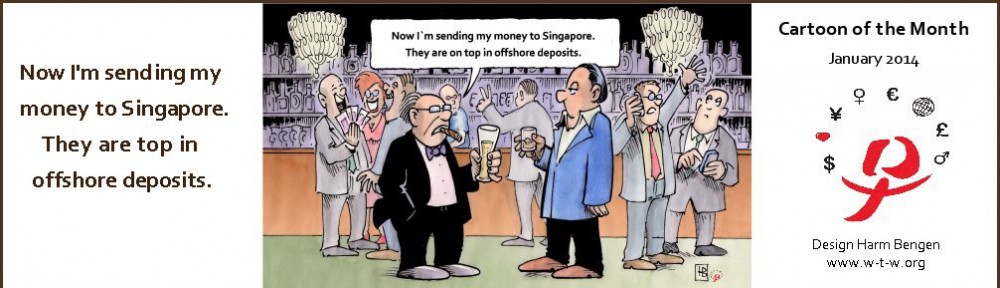

But the Lux leaks are not just fueling criticism in European political circles. European citizens have suffered through five years of tough austerity, spurred by a global financial crisis that is widely considered to be the fault of greedy bankers and financiers. In this context, public opinion risks becoming very hostile, not only toward the Luxembourg government, which Juncker led for almost 20 years, but also toward the European Commission that he now heads.

What happened in Luxembourg was legal. What it really shows is that in an international economy tax policies should also be international. It is difficult for US companies to compete internationallly when their tax burden is so much greater than corporate tax assessments in other countries around the world.