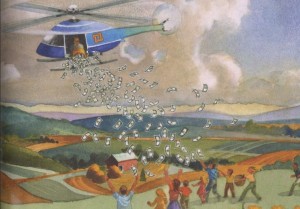

John Muellbauer writes: It is now a near certainty that, by the end of this year, falling energy and commodity prices will push annual inflation in the eurozone below zero – well under the European Central Bank’s target of near 2%. Rather than continue to allow misguided conventional thinking, centered on German economic ideology, to impede effective action, the ECB must pursue quantitative easing (QE) “for the people” – an adaptation of Milton Friedman’s “helicopter drops” strategy – to reverse deflation and get the eurozone back on track.

As it stands, conventional monetary policy has had – and American-style QE will have – little impact on the eurozone’s core countries. This can be explained partly by the fact that, when it comes to credit provision, capital markets do far less of the heavy lifting in the eurozone than in the United States. As a result, bringing down yields on government, corporate, and asset-backed bonds has less impact.

At the same time, the euro exchange rate – the one mechanism whereby current policies could still make a difference – cannot be pushed down much further. In Germany, France, and Italy, higher house prices spur non-owners to save more for the down payment and inspire caution among tenants, who expect future rent hikes. And the housing wealth of existing owners does not translate into significantly higher spending, given the lack of access to home-equity loans and cheap mortgage refinancing. Finally, in countries like Germany, where households’ bank and saving deposits far outweigh their debt, lower interest rates reduce total household spending.

Another factor impeding QE’s impact in the eurozone is low bond yields, which, by increasing measured pension-fund deficits, make some companies reluctant to invest.

US-style QE channels more money toward the wealthy, who have a lower propensity to spend, without providing much to the poorer people who would use it to consume more. In the eurozone, the distribution issue is especially complex, given that institutional differences between countries can give the impression of discrimination among them.

Clearly, the ECB must develop a strategy that works in the eurozone’s unique system.

One simple solution would be to distribute the funds to governments, which could then decide how best to spend them in their countries. But the eurozone’s rule against using the ECB to finance government spending bars this approach.

A more feasible option, therefore, would be to provide all workers and pensioners with social-security numbers (or the local equivalent) with a payment from the ECB, which governments would merely assist in distributing. Another alternative would be to use the electoral register, a public database that the ECB could use independently of governments.

Of the roughly 275 million adults with social-security numbers in the eurozone, some 90% are on the electoral register. Beyond lifting the eurozone economy out of deflation, such an initiative would have massive political benefits, as it would reduce resentment toward European institutions, especially in struggling countries like Greece and Portugal, where an extra €500 would have a particularly strong impact on spending.

Germany may resist this approach by marshaling arguments about prudence and responsibility. But the fact is that Milton Friedman’s “helicopter money” would work – and nothing in eurozone law prohibits it.

After years of austerity, infighting, and unemployment, it is time to implement a QE program that delivers what Europe needs.