Deutsche Bank is in trouble, some of it its own making. Its history is in many ways the history of big banks in the 20th going into the 21st century. To sum up:

1. About 25 years ago DEutsche Bank started its transformation from a small German lender to a global investment bank, trading bonds, currencies and commodities (FICC).

2. DB offered issuing of bonds, hedging of foreign exchange risks to its corporate clients, mostly mid sized colmpanies in Germany.

3. Gobal markets gave DB a chance to speculate for its own account and DB shares traded at twice the vallue of tangible DB assets.

4. The outsized FICC business becomes a liability andthe hgiher the ahreof cinome from trading, the lower the share price.

5. European banks argue that they need a trading floor to serve corporated clients.

6. Low interest rates and bond market stability make corporate clients less prone to juggle their accounts

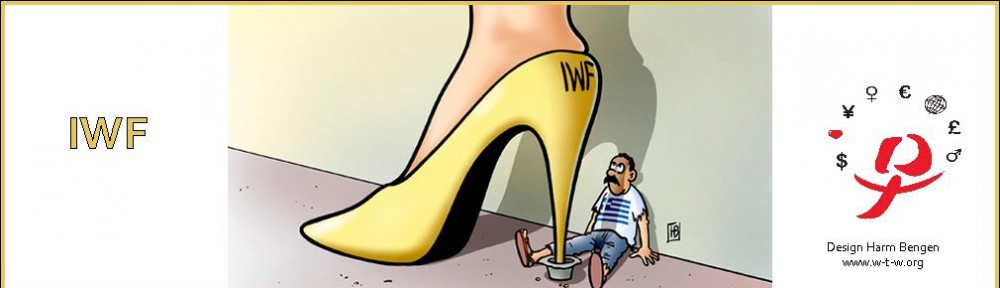

7. All the big banks have been subected to big fines including DB.

8. Post recession regulation is a big drag on big banks. Rules imposed on domestic lenders in the US will be extended to foreign banks. Regulators in the US have called DB reprorting, “low quality, inacurate, and unreliable.